JD Capital Invests in Education Sector: Noticing the Trend of Diversified Investment, Pursuing the W

2016-10-17

Source: China Venture

Up till now, JD Capital has invested in many segments of education. Finished and on-going cutting-edge projects cover different areas such as early education, academic education, quality education and vocational education.

Recently, Gaosi Education Technology Co., Ltd (hereinafter referred to as “Gaosi Education”) has submitted an application for the listing on the National Equities Exchange and Quotations (NEEQ), the over-the-counter stock exchange in China. According to information available, Gaosi Education focuses on the research and development of K12 educational products, online education and offline education, providing product solutions and teaching service to students in primary and secondary schools. It means that the first educational enterprise invested by JD Capital is about to enter the capital market.

“With the development of internet technology, traditional education is now experiencing the integration with new technologies, which is expected to restructure users’ learning process and learning experience. Traditional teaching methods are being changed by new teaching tools. An increasing number of advanced educational technologies is being introduced to China. Educational bonus brought by those emerging technologies can help improve teaching efficiency, optimize educational resources allocation, and change the idea of ‘teaching and learning’. As the education industry develops, the industry bellwethers are finding their way into the capital market, making themselves bigger and stronger,” said the head of education investment of JD Capital.

Up till now, JD Capital has invested in many segments of education. Finished and on-going cutting-edge projects cover different areas such as early education, academic education, quality education and vocational education.

Critical Thinking and Clear Justification: China’s Education in Changing Times

“The education industry in China is undergoing profound changes, so are the policy environment, industry trends, educators and consumers of education. All these changes promise a series of opportunities for China’s education industry, and push the industry into a new historical era featuring diversified, rapid development,” said the head of education investment of JD Capital.

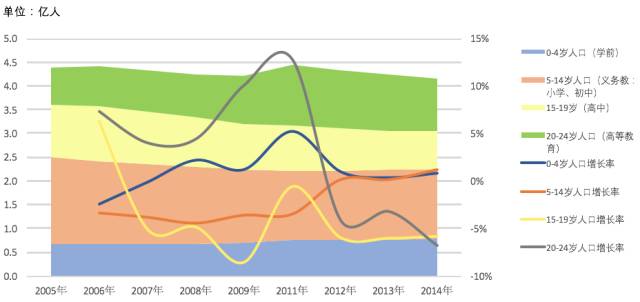

China’s demographic change has become the principal determinant of the changing educational needs. “Both the consumer structure and consumption habits are changing”, according to JD Capital. For example, at the demand side of the educational industrial chain, apart from the basic educational needs arising out of the exam-oriented education at the K12 stage, among children, teenagers and adults, the needs for life-long education, quality education and vocational education are increasing rapidly.

What’s more, the “concept upgrading” of parents has also brought fundamental changes to educational philosophy. Post-80s and post-90s parents, as the major future education consumers, hold different education philosophies. They pay more attention to build all-round characters in their children, and refrain from forcing children into standard and closed education. “As these parents become more well-educated and have a stronger purchasing power, the education consumption structure has already changed a lot, and the consumer groups are more willing and competent to spend more,” said the head of education investment of JD Capital.

Figure 1: Demographic Structure of School-age Population from 2005 to 2014

Data Sources: China Statistical Yearbook

JD Capital, based on the analysis of the changing tendency of China’s education, attempts to divide the evolution of China’s education industry into two stages, namely the “Stage 1.0 of China’s Education” featuring extensive growth against the background of “livelihood guarantee”, “compulsory education” and “traditional education”, and the booming “Stage 2.0 of China’s Education” driven by three themes, namely “loosened policies”, “demographic structure and preference changes”, and “technological education”.

Stage 1.0 of China’s Education:

Extensive Industrial Growth and Low Securitization Ratio.

Consistent with China’s revolution and development, Stage 1.0 had maintained a rapid growth for over 30 years after China opens its economy to the outside world. The development mode of education at that time features insufficient supply of high-quality resources.

In such a traditional mode, by increasing financial support, the government created numerous educational opportunities, with the aim of achieving the “universality” of higher education and the availability of primary and secondary education.

“Under this trend, the education industry, in a rather extensive way at Stage 1.0, achieved rapid development in traditional offline education”, said the head of education investment of JD Capital.

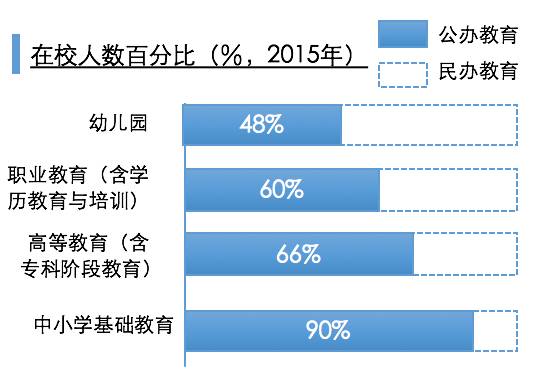

During this period, the separation between public education and private education was quite clear. On the one hand, the government played a major role in compulsory education and educational fields concerning public interests. Educational institutions, ranging from kindergartens to universities and colleges, were largely non-profit public schools. On the other hand, private education, as a complementary to public education, expands market with diversified education services. Overall, the private education was still in its infancy, lacking leading enterprises in most of its segments.

Figure 2: Percentage of School Enrollment in Public and Private Schools

At Stage 1.0 of China’s Education, capital involvement was quite limited, and both the securitization ratio and concentration ratio of the industry were quite low. The head of education investment of JD Capital explains the above-mentioned situation as follows:

On the one hand, the non-profit nature of property right made the investment’s exiting channel quite unclear. Therefore, the capital could only exit through overseas capital markets. On the other hand, private education, limited by the gap in education resources and financial allocation, was inadequately competitive, lacking leading enterprises with a greater growth potential.

Stage 2.0 of China’s Education:

Favorable Industrial Policies Issued, Leading Enterprises Are Gaining Momentum

Draft Amendments to the Education Law of the People’s Republic of China, the Higher Education Law of the People’s Republic of China, and the Law on the Promotion of Private Education were adopted at the Executive Meeting of the State Council in 2015, allowing the establishment of for-profit private schools.

“The adoption of the amended Law on the Promotion of Private Education is crucial for the launching of educational institution securitization. As the path to profitability becomes clearer and clearer, more and more social capital will be attracted into education and school-running investment,” according to JD Capital. What’s more, the two-child policy adopted by the fifth plenary session of the 18th CPC Central Committee also brings more market demand to the education industry.

After Stage 1.0, the amount and scale of the education industry have accumulated to a certain level. At Stage 2.0, the whole industry is turning to a comprehensive development mode which features optimized education resources and improved education quality. The needs for education have changed from “availability” to “quality”, and from “universal” education to “high-quality” education.

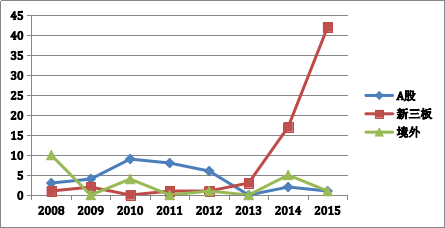

“At Stage 2.0, the concentration ratio and securitization ratio of the education industry will be greatly enhanced”, said the head of education investment of JD Capital. In 2015 and 2016, the A-share market has already witnessed a sharp growth in the number of listed educational enterprises and the size of asset transactions.

Figure 3: Number of Listed Educational Enterprises from 2008 to 2015

Data Source: Deloitte Consulting

“Supported by the revolution of industrial policies, and stimulated by the internal demand and driven by capital, the education industry will generate more space for securitization. We remain positive on the rise of securitization ratio of the future education industry. At the same time, we pay great attention to segmental leading enterprises boasting the potential for integration,” said the head of education investment of JD Capital.

Investment Hotspots Continue to Spring Up:

Join Hands with Industry Bellwethers on the Road to Refined Development

China’s education industry presents new trend of development in many market segments. On the one hand, life-long education is becoming increasingly acceptable by the whole society, and educational demands are being more diversified, which brings forth new trends of the development of vocational education, skill training, corporate training. On the other hand, as both the customer needs and the teaching mode change, the supply mode of education is becoming increasingly diversified. Therefore, JD Capital will arrange its investment centering on two themes, namely “life-long education” and “diversified education”.

“We are particularly fond of emerging educational enterprises that can meet consumers’ demand; and we are willing to support those promising leading enterprises to leap ahead,” said the head of education investment of JD Capital.

Reportedly, as a leading enterprise in the field of K12 education and training, Gaosi Education, with full support from JD Capital, has already invested tens of millions of yuan in its research and development, released online B2B platform and expanded 2C and 2B businesses before making the application to be listed on the NEEQ.

“Now we are cooperating with Gaosi Education in the establishment of industrial investment fund, and helping the teaching platform ‘Aixuexi’ to be better positioned in the domestic K12 market,” said the head.

A new era featuring education capital M&A and securitization has come. The education sector of JD Capital is pursuing partnership with many famous educational enterprises at home and abroad in equity investment.

“We are confident that we can build several leading enterprises of education industry segments, and bring a decent return to investors,” the head of education investment of JD Capital added.