The Race for the "Joint": The Race and Bet on the Singularity of Humanoid Robots | JD Insights

2026-02-02

(Image generated by DouBao AI)

Abstract: Core components breaking through under cost constraints.

Research Team | JD Capital Advanced Manufacture Investment Department

Managing Director,Wang Yong wangyong@jdcapital.com

Senior Investment Manager ,Zhang Yijia zhangyjc@jdcapital.com

……

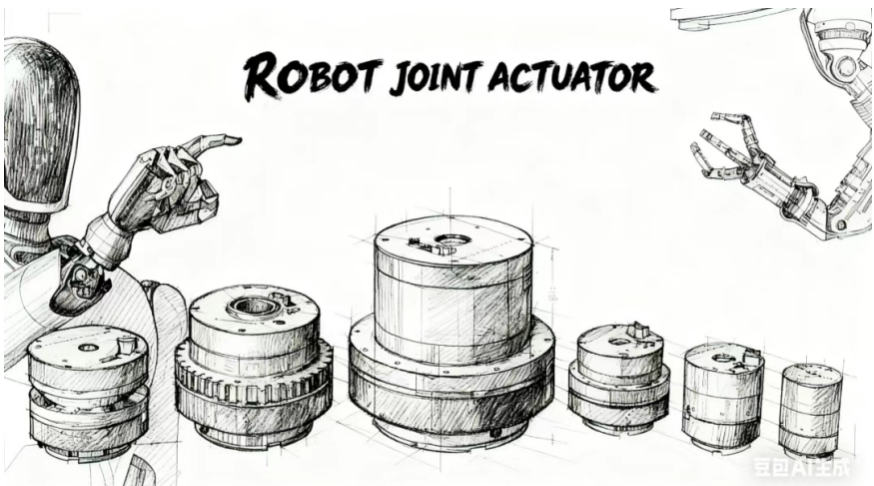

As the humanoid robot slowly bends its elbow and rotates its wrist, dozens of joint modules within its body operate simultaneously: motors drive the reducer to deliver precise torque, encoders record every angle and speed change in real time, while the driver continuously adjusts current in millisecond-level response—ensuring the movement is both accurate and smooth.

These joint modules of varying sizes constitute the true 'muscles' and 'nerves' of the robot. They determine whether the robot can stand steadily, walk with balance, or even take that symbolically significant 'first step'.

In the context of the entire machine, the joint module holds a position analogous to that of the engine in a car or the chip in a smartphone. In Tesla's Optimus, its cost accounts for nearly half of the total machine, making it the heaviest and most critical link in the humanoid robot industry chain.

JD Capital identifies joint module costs as the industry's Achilles' heel. A robot's ability to transition from lab prototypes to commercialization hinges not only on AI algorithm sophistication, but more crucially on whether these precision components can achieve price reductions from 3,000-4,000 yuan to the 1,000-yuan range while maintaining performance. At this stage, the company believes that whoever can develop 3,000-4,000-yuan "precision joints" into 1,000-yuan standard components will redefine the cost structure of humanoid robots.

Now, a battle over "thousand-yuan joints" in China manufacturing is quietly unfolding. This is not only a technological competition, but also a long-term game about manufacturing efficiency, supply chain integration, and cost limits. The outcome will ultimately determine how far humanoid robots are from achieving true large-scale implementation.

I.The Breakthrough of Manufacturing under the Cost Tyranny From "Thousand Yuan Joint" to Yield Battle

JD Capital maintains that the fundamental principle of the humanoid robotics industry boils down to one key factor: cost.

Let's break down the numbers: A manufacturing worker's annual salary is currently around 80,000 yuan, while the cost of a humanoid robot still ranges between 100,000 to 200,000 yuan. For robots to truly replace human labor, manufacturers must ensure customers recoup their investment within 1 to 2 years. This financial pressure ultimately gets passed on to upstream suppliers.

The industry consensus is that halving the joint module cost can reduce the overall machine cost by half. Today, when selecting models, downstream manufacturers first consider: How can product costs and prices be controlled while maintaining superior performance? Even with top-tier performance and precision, commercial viability is impossible without significant cost reduction. While America's Kollmorgen offers frameless torque motors with exceptional performance, and Japan's Harmonic Drive Systems produces world-class reducers, domestic robot manufacturers prioritize domestic supply chains due to cost considerations.

Tesla's Optimus has set a clear "cost line" for the industry: $20,000. This price not only represents its own target but also serves as a "life-or-death line" across the entire supply chain.

Through this reverse-engineering approach, JD Capital has observed that the market price of joint modules is rapidly declining from the 3,000-4,000 yuan range toward the 1,000-yuan threshold. According to Tesla's vehicle cost model, the price of individual modules may even be pushed below 1,000 yuan in the future.

The "thousand-yuan joint" thus becomes the sole "Maginot Line" in this humanoid robotics industry battle. Only those who first cross this line can truly remain at the table.

At this stage, cost reduction transcends mere efficiency—it becomes the fundamental question of whether an industry can launch or a business can survive. When cost becomes the paramount directive for the entire sector, all technological advancements must revolve around this ultimate goal. Through industry research, JD Capital found that companies are not sitting idle but are actively unveiling their "three key strategies" for cost reduction.

The first step: scale.

In industrial manufacturing, scale means efficiency, which ultimately determines costs. Take the reducer industry as an example: A domestic manufacturer surveyed by JD Capital currently produces no more than 10 models, yet each model achieves annual shipments exceeding 10,000 units, driving unit prices below 1,000 yuan. In contrast, another manufacturer with over a thousand models suffers from low shipment volumes per product, negligible economies of scale, frequent production line switching, and low manufacturing efficiency, resulting in higher costs. This perfectly illustrates a fundamental industrial principle: Without scale, there can be no cost advantage.

The second move: design.

True cost reduction has never been about blindly lowering prices, but rather "designing it out." Nowadays, China's module manufacturers are shifting from a "top-spec mindset" to a "scenario mindset" —no longer blindly pursuing performance limits, but redefining "good enough" based on different application scenarios. Take encoders as an example: optical encoders have the highest precision and the most expensive price; magnetic encoders are slightly less powerful but cost less.

When the complete system is deployed in entertainment, education, and exhibition sectors, module manufacturers can readily adopt cost-effective solutions instead of high-cost alternatives. Similarly, planetary gearboxes may replace expensive harmonic gearboxes when customers prioritize operational stability over precision. Each design decision ultimately represents a strategic cost optimization.

The third move: self-research.

When external procurement can no longer meet cost constraints, vertical integration becomes the only viable solution. JD Capital observes that an increasing number of module manufacturers are extending upstream, reclaiming key components to regain cost control. Previously, they heavily relied on external procurement of drivers, encoders, and reducers, but now are actively developing these components in-house.

The industry consensus is to "consume the outsourced components." Some companies now develop their own drivers, planetary reducers, and encoder software, even integrating force control algorithms directly into modules to achieve hardware-software integration. This approach not only reduces unit costs but also cuts debugging cycles and compatibility risks. "Self-developing core components" has become the fundamental logic for cost reduction. Through a flexible "in-house development + partial outsourcing" strategy, module manufacturers are striving to carve out new profit margins at every critical juncture.

When the "thousand-yuan threshold" becomes an industry-wide constraint, enterprises face not only cost pressures but also a persistent challenge: yield rates.

The mass production of joint modules is essentially an invisible "yield battle". In this industry where engineering precision is paramount, motors, reducers, encoders, and driver boards are nested layer upon layer. Even the slightest error in any component can cause deviations in the entire system. During manual assembly, errors are nearly unavoidable. This means the real breakthrough lies not in laboratories but on factory production lines. Though challenging, this is the inevitable path for humanoid robots to transition from "prototype" to "mass production".

Looking back at the past few years, China's joint module industry remains in a typical "handicraft era". Manual winding, manual welding, manual wire binding... These processes are ubiquitous on most production lines. JD Capital believes this is an inevitable stage for the industry to progress from "0 to 1", but it has also become the biggest obstacle to its industrialization. "Hand-crafted" means poor consistency, unpredictable lifespan, and low yield. If the motor magnet is slightly misaligned, it will no longer run "smoothly", with increased vibration, accelerated bearing wear, and a lifespan gap that can even be several times.

In this highly process-intensive industry, manufacturing techniques are becoming the decisive factor for success or failure. To truly enter the industrial era, the industry must completely bid farewell to the "handicraft" era.

A case study from JD Capital reveals a joint module manufacturer's operational transformation: upgrading production lines from manual wire sorting to PCB-based assembly welding. What once required manual wire organization now achieves precise soldering through a single circuit board, resulting in a more structured and efficient assembly process. This subtle change has significantly improved yield rates, stability, and consistency.

More importantly, in the industrial context, this is not just a process optimization, but the starting point for the China humanoid robot industry to truly move towards standardization and automation.

II. Integration threshold:Architectural Restructuring and Multi-Route Co-evolution of Technology

When "standardization" becomes an industry imperative, "integration" ceases to be merely a trend and becomes the gateway to the competitive arena. Currently, nearly all joint module manufacturers are advocating for "integration," yet the level of integration among different enterprises has already created a generational gap.

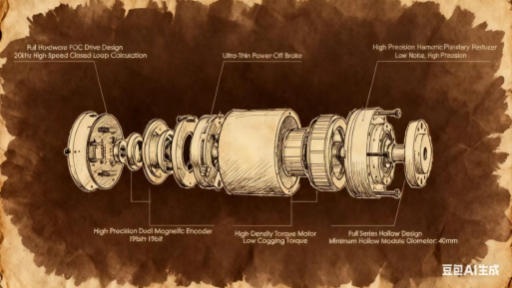

Traditional integration was largely mechanical assembly—merely stuffing drivers, motors, and reducers into a casing to achieve structural integration. The new generation of integration, however, represents a systematic redesign. When downstream manufacturers specify particular spatial dimensions, module suppliers must redesign layouts with millimeter-level precision: integrating components like drivers, encoders, frameless torque motors, and reducers into a tight space with virtually no spare room.

This is not a simple stacking, but a "redesign". Every component—whether it be a motor, reducer, driver, or encoder—requires redefining dimensions, interfaces, and heat dissipation paths at the system level.

JD Capital maintains that true integration fundamentally requires achieving the optimal balance among performance, cost, and reliability within constrained space. This demands module manufacturers evolve from 'component integrator to 'system architect,' mastering both material processes and thermal management with precision.

In a highly integrated environment, even the slightest imbalance may trigger a chain reaction—excessive temperature rise, drive misalignment, signal drift, or false alarms leading to shutdown. For manufacturers, this is not merely an engineering challenge but a critical test of system stability.

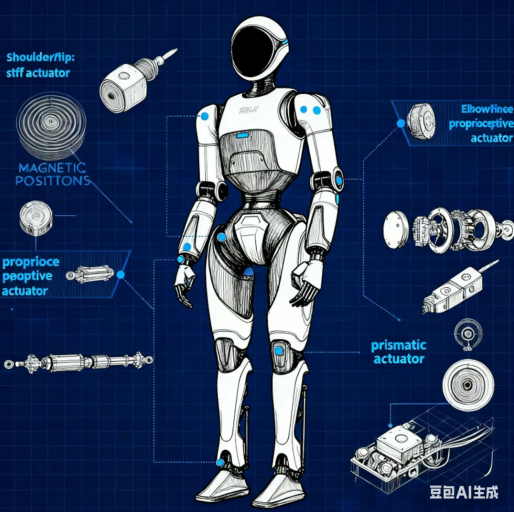

It is precisely during this process that the multi-path advancement of joint technology has gradually emerged. The market typically categorizes the joints of humanoid robots into two types: rotary joints and linear joints. The former predominantly employs harmonic or planetary mechanisms, which are applied to flexible rotational areas such as the neck and wrist; the latter primarily utilizes lead screw-roller transmission, designed for high-load-bearing scenarios like the lower limbs.

When Tesla implemented the hybrid "rotary motor + cylindrical lead screw" system in its Optimus, industry observers initially assumed linear joints would replace rotary joints. However, JD Capital's analysis reveals that these technological approaches are not mutually exclusive but rather coexist through scenario-specific specialization. Rotary mechanisms embody agility, while linear systems represent structural strength—each with distinct advantages. Entertainment-oriented and lightweight robots typically favor rotary solutions, whereas heavy-duty, rehabilitation, or industrial robots are better suited to linear drive systems.

Ultimately, the success or failure of a technological approach is not determined by individual performance metrics, but by its application scenarios. The maturation of an industry often signifies that the competition over technical routes becomes less extreme and more collaborative—different architectures leverage their respective strengths in specific domains to form a truly optimal system solution.

The discussion around different technical routes also brings to the surface another deeper question: Is China's supply chain, upstream of the joint module, ready?

JD Capital found in industry research that, apart from a few high-precision ball screws (C4 grade and below) still monopolized by overseas manufacturers, the core components required for joint modules—frameless torque motors, harmonic reducers, encoders, and drive boards—have almost all been localized. In other words, except for the extreme precision demands at the "top of the pyramid," China's supply chain can already support the vast majority of scenarios for humanoid robots.

Supporting this judgment is the still-expanding "industrial forest" of China's manufacturing sector.

First, the completeness of the system. Globally, China is one of the few countries capable of independently completing the entire chain from materials, processing, assembly to testing. From upstream copper wires and aluminum materials to downstream connectors and control chips, almost all components can be locally resolved. For this reason, a significant portion of the supply chains of global automakers, including Tesla, has long been deeply embedded in China.

Second, cost stability. A complete supply chain means shorter transmission paths and lower collaboration friction. The high-frequency coordination and large-scale production between upstream and downstream enable China's manufacturing to possess a globally unique cost control capability—not only to make parts cheaper but also to ensure stability. This structural cost advantage is the realistic prerequisite for the existence of all "thousand-yuan modules".

Third, the speed of iteration. When industries cluster at sufficient density, innovation ceases to be an isolated event and becomes a daily practice. Engineers only need a phone call to have supporting manufacturers modify models, adjust parameters, and produce samples the next day. The time gap between R&D, prototyping, and mass production is compressed to the extreme in China. This rapid iteration capability is one of the most scarce competitive advantages in today's intelligent manufacturing industry.

In JD Capital's view, such a supply chain ecosystem is the fundamental fulcrum for the "accelerated start" of China's humanoid robot industry—it makes cost reduction not just a goal, but an executable reality.

Ⅲ.Game from the Perspective of Investment:How to bet on a "barrier-free" war?

From an investment standpoint, the joint module sector presents a seemingly attractive opportunity: it features rigid demand, high cost penetration, clear growth prospects, and strong industry certainty.

However, the nature of the industry determines the ruthlessness of its competition. The joint module market is not a "winner-takes-all" arena but rather a scale competition lacking barriers. In China's highly mature and finely divided manufacturing system, the "moat" at the hardware level can be easily eroded quickly, and product homogenization and price competition will soon become the norm. This means that who can achieve mass production faster and who can establish an efficiency advantage in the supply chain will be the key to determining whether a company can break through.

Against this backdrop, the future market landscape may evolve into two distinct categories of key players:

The first category comprises niche market hidden champions that specialize in single core components and gain competitive advantage through technological sophistication, such as module manufacturers focused on high-performance motors and precision reducers.

Another category comprises industry leaders that develop systematic capabilities for specific application scenarios, such as companies specializing in vertical fields like rehabilitation robots and service robots.

For investment institutions, this shift in industry landscape has also driven the evolution of investment logic. Although the joint module sector remains in its early stages, investment focus has gradually shifted from the past emphasis on 'vision and storytelling' to evaluating companies' engineering capabilities and industrial implementation prowess.

Therefore, JD Capital has distilled its investment logic into a 'three-tier funnel' framework, systematically focusing on three core dimensions from the outside in: orders, deliveries, and teams.

First layer: Orders. Focus on the customer structure and quality of the enterprise. High-quality customers not only reflect market recognition but also indicate that the product has undergone rigorous commercial validation.

Second layer: Delivery. Evaluate the enterprise's production consistency, yield, and performance compliance. Delivery capability includes product quality stability, production efficiency, and whether the performance meets the requirements of the end-user manufacturer, which directly determines whether the enterprise can establish a stable position in the industrial chain.

The third layer: Team. Focus on the experience and capability accumulation of core management and technical backbone. In highly competitive industries with rapid technological evolution, the team serves as the fundamental guarantee for enterprises to maintain innovation and continuous optimization.

IV.Critical point approaching:Waiting for the large-scale explosion of humanoid robots

In the rapid evolution of humanoid robot industry, joint module is generally considered as the most deterministic link.

In contrast, the technical approaches and solutions for components such as dexterous hands remain more diverse and exhibit greater uncertainty. The application scenarios of joint modules extend far beyond humanoid robots, encompassing areas like quadruped robots and collaborative robotic arms, offering both a vast existing market and rapidly growing incremental potential.

Therefore, JD Capital believes that joint modules are poised to become one of the earliest commercialized segments to achieve profitability.

The technical and industrial infrastructure for the entire sector is now largely in place, with the decisive factor for industry growth being large-scale production downstream. Ultimately, the joint module market will only truly take off when downstream manufacturers achieve mass production, thereby breaking through the demand threshold.

Whether this catalyst stems from Tesla's mass production launch of "Gen 3" or "Gen 4", or from a domestic "catfish" company pioneering a closed-loop business model, the industry's critical juncture will mark a watershed moment. At that point, competition will swiftly transition from conceptual and R&D phases into an "industrial era" focused on manufacturing efficiency, delivery reliability, and cost control capabilities.

At that stage, what determines the winner is no longer the superiority of algorithms or computing power, but who can create a faster, more stable, and more cost-effective "body". And on every joint of this "body", there is likely to be the same mark engraved—Made by China.