Intense Competition? Long-Duration Energy Storage: The Beginning of a New Race | JD Capital Insights

2024-03-12

Shared by.

Research Team | JD Capital Manufacturing Investment Division II

Contact Information linhl@jdcapital.com

“The energy storage rat race has no winner, only fiercer competition," said Zhu Gongshan, chairman of GCL Group, during the 2023 Shanghai SENC Exhibition.

How intense is the competition?

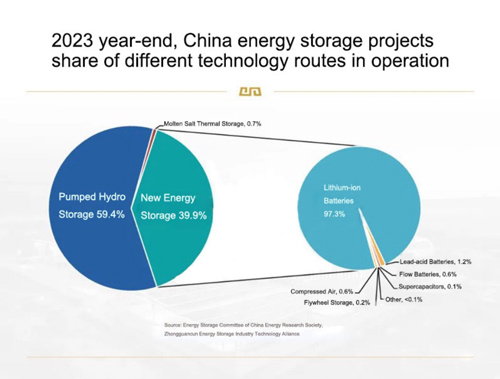

The "The Action plan for Carbon Peak Before 2030" (No.23 [2021]) issued by the State Council proposes that by 2025, China's installed new energy storage capacity should reach over 30GW. According to data from the Zhongguancun Energy Storage Industry Technology Alliance, by the end of 2023, China's cumulative installed new energy storage capacity had reached 34.5GW/74.5GWh. Among these, newly operating capacities are 21.5GW/46.6GWh, three times that of the year 2022.

The underlying logic is that, against the backdrop of “Double Carbon” goals (Carbon Peak and Carbon Neutrality), wind and photovoltaic installations grew rapidly. However, their inherent instabilities pose a significant challenge to grid stability. Additionally, the difference between the wind & solar generation curve and the electricity consumption curve makes it increasingly difficult to adjust peak load, thereby affecting the integration of new energy sources.

If energy storage stations are built in conjunction with wind farms and photovoltaic power stations, the excess power generated can be stored in this "large power bank" for later use, enhancing the efficiency of the power system's operation.

Therefore, the rollout of "wind-solar-storage-pairing" (or new energy storage pairing) policies has led to a rapid increase in the demand for energy storage.

Although the market's growth prospects are certain, in recent years, energy storage production capacity has been rapidly released, leading to excess supply, and lowered product prices. The 2024 annual battery cell frame tender announced by Zhongchuang Technology shows that the quote price for energy storage cells has dropped to 0.409 yuan/Wh, a decrease of over 50% compared to Jan 2023 floor price.

Various signs indicate that although China's new energy storage industry started relatively late (around the time when the “double carbon” goals were proposed in 2020), it is growing fast. Following a development path similar to the photovoltaic industry, characterized by overcapacity, product homogenization, and increasingly fierce price wars.

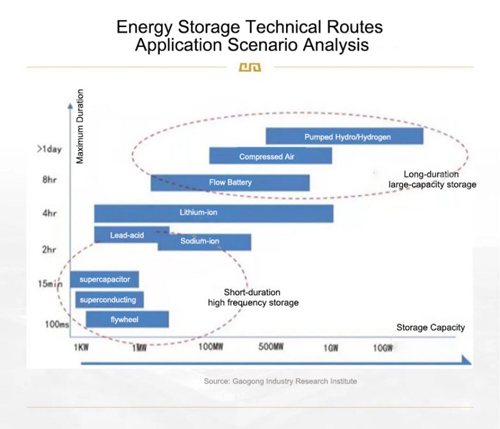

It should be noted that the current competition in the new energy storage industry mainly manifests in short-duration energy storage (generally 2 hours or less) that primarily relies on lithium batteries.

As the proportion of solar and wind installations continues to rise, the mismatch between generation and terminal electricity demand becomes increasingly profound, highlighting the importance of long-duration energy storage. Long-duration energy storage, characterized by longer cycles and larger capacity, can regulate the supply of new energy electricity over longer horizons.

In August 2021, the National Development and Reform Commission and the Energy Bureau issued a “notice encouraging renewable energy generation companies to build or purchase peak-adjusting capacity to increase scale of grid integration”. It requires "new renewable energy generation projects beyond the grid companies' guaranteed grid connections to be paired with more than 4 hours of peak-adjusting capacity." Subsequently, Inner Mongolia, Xinjiang, Liaoning, Hebei, Shanghai, and other regions responded, proposing requirements for storage durations of more than 4 hours.

Global consulting firm McKinsey predicts that long-duration energy storage’s potential market will grow significantly beginning 2025, global cumulative installed capacity will reach 30-40 GW and total investment around USD $50 billion.

In JD Capital's view, compared to short-duration energy storage, long-duration energy storage, as a recently emerging sub-market, has higher barriers of entry and a better competitive environment.

I.Policies Set in Place to Resolve Commercialization Challenges

Based on different demand scenarios, energy storage can be categorized into: large-scale utility storage, commercial & industrial storage, and residential storage. Among these, large-scale utility storage serves the generation side (power stations) and the grid side (power companies). Long-duration energy storage typically falls under large-scale utility storage.

Currently, the new energy storage industry is primarily driven by policies.

According to statistics from the Zhongguancun Energy Storage Industry Technology Alliance, from 2021 to 2023, the national and local governments introduced near 1200 policy items directed at energy storage. Especially regarding new energy storage, the central government sought to "encourage" the use of new energy storage, but municipal governments have gradually adopted a “Mandatory ”stance in actual implementation.

Therefore, the new energy storage industry, especially the lithium batteries dominated short-duration storage, in the absence of market value, faces widespread over capacity (built but not utilized), and even "bad money driving out good" phenomenon.

Take generation-side storage as an example, due to restrictions on storage capacity and duration, its role in aiding the power consumption for generation-side companies is relatively limited. These companies construct energy storage with the sole purpose of meeting construction approval requirements, with little consideration for actual operation, therefore, a tendency towards lowest cost solutions, e.g., abandoning electricity during certain periods.

On the other hand, according to China Electric Power Network, the initial investment increases by 8-10% for a photovoltaic power station to construct a storage project with 20% of the installed capacity; for a wind farm to construct a storage project with the same capacity, the initial investment cost increases by 15%-20%.

Since constructing storage significantly increases the initial investment cost of projects, new energy enterprises tend to choose energy storage products with lower initial costs. There was a phenomenon during bidding, where "the lowest bid always wins."

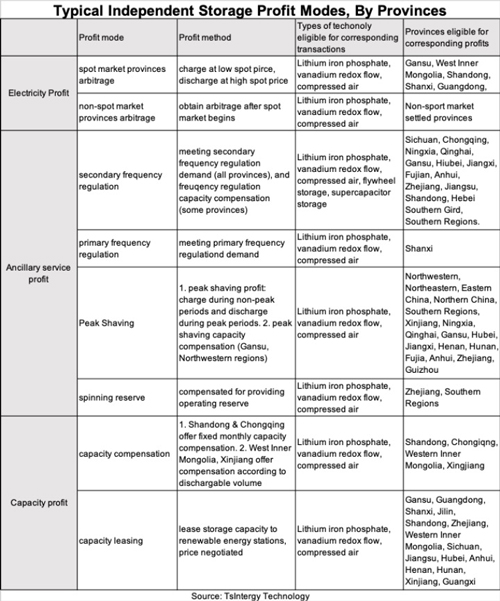

Regarding investment returns, the main profit channels for large-scale utility storage include:

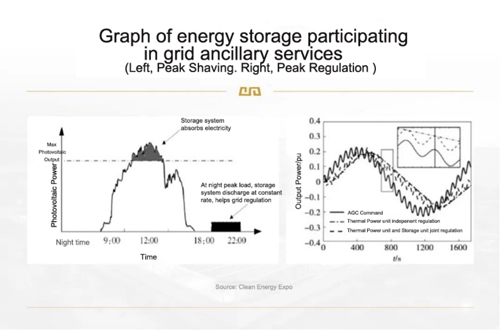

1, On the electricity supply side, participate in electricity spot market transactions, pay market price when charging, then discharge and sell back to the market, profit from the arbitrage between peak and off-peak electricity prices.

2, On the grid side, provide Ancillary services such as peak regulation and frequency modulation for power systems. For example, changes in frequency can affect operation safety, efficiency as well as lifespan of equipment. Energy storage (especially electrochemical storage) frequency modulation can switch quickly and flexibly between charging and discharging states.

3, Obtain government subsidies. For instance, independent energy storage stations on the grid side implement a capacity price mechanism, where the government or a specific institution sets the capacity compensation price based on fair assessment. This amount is then paid to the relevant power generation companies with the costs generally shared among electricity users.

Take a 100MW/200MWh energy storage station in a certain province as an example, according to publicly available data, its annual investment return can reach 51 to 56 million yuan.

Participating in electricity spot market transactions: The average electricity price difference obtained in two hours is about 0.5 yuan/kWh. With an 85% cycle efficiency, operating 330 days a year and calculating one charge-discharge cycle per day, also taking energy storage operation and other factors, the annual profit can reach about 20 million yuan.

Participating in Ancillary services: For peak regulation, during 2021 provincial pilot project period, independent energy storage stations were compensated at 0.2 yuan/kWh, with a guaranteed usage of 1000 hours/year, annual compensation totals 20 million yuan; for frequency regulation, large energy storage stations participating in both primary (small-scale fine-tuning) and secondary (large-scale coarse adjustments) frequency regulation can earn an annual income of 5 to 10 million yuan. However, an energy storage station may not be able to cover all Ancillary services, it would depend on the grid’s need.

4, Obtaining government subsidies: According to the latest policy in that province, the capacity compensation for a 100MW/200MWh independent energy storage station can reach 6 million yuan/year.

Based on the current investment standards for lithium-ion storage, the total construction cost (EPC) for 2-hour storage is about 2 yuan/Wh, and the investment amount for a 100MW/200MWh storage station is around 400 million yuan. Operationally, to ensure the project does not operate at a loss, the station needs to achieve annual income above 60 million yuan.

Clearly, even under ideal conditions, a gap still exist between the actual and expected returns of an energy storage station.

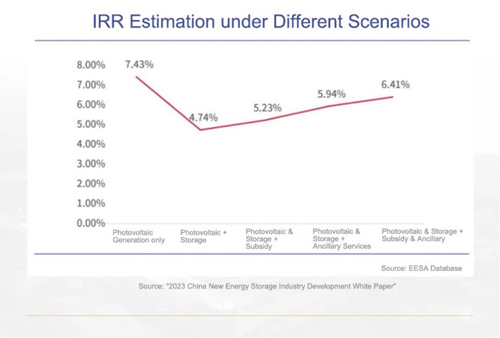

For photovoltaic and wind power companies, storage pairing means an increase in investment and a decrease in the rate of return.

The "2023 China New Energy Storage Industry Development White Paper" calculation shows: For a 100MW photovoltaic power generation project in Inner Mongolia with a supporting 20MW/40MWh energy storage station, the IRR for generation only, is a high 7.43%; however, after pairing with energy storage, even with government subsidies and participation in Ancillary services, the IRR is reduced to 6.41%.

Although the “built but not used” phenomenon has not yet occurred in the long-duration energy storage industry, its initial investment cost is much higher than that of short-duration storage.

To address the commercialization challenges of new energy storage pairing, the industry has recently experimented with a "shared energy storage" model:

Where a centralized, large-scale independent energy storage station, in addition to meeting its own needs, provides services to other new energy stations. For power generation companies, this reduces the construction costs of storage pairing and lowers operation and maintenance costs; for grid companies, having multiple centralized medium-to-large energy storage stations helps with grid balancing.

Encouraged by the National Development and Reform Commission, the Energy Bureau, and local governments, shared energy storage stations are generally built by local state-owned corporations and are large in scale. There are also shared storage stations constructed by grid companies.

In terms of fees, the standard varies by province. Shandong and Hunan, are provinces seen as typical representations for shared energy storage, have storage leasing costs of about 350 yuan/KW and 450-600 yuan/KW, respectively.

JD Capital’s research found that in regions like Jiangsu and Zhejiang, there is a significant difference between peak and off-peak electricity prices, and the IRR for shared energy storage stations can exceed 7%. This meets the investment benchmark IRR for many central and local state-owned enterprises.

Furthermore, in JD Capital’s view the intensification of competition in the new energy industry - photovoltaics and wind power - is leaving more room for the energy storage industry in terms of cost.

Take photovoltaics as example, a report by IRENA (International Renewable Energy Agency) shows that between 2010 and 2019, the average cost of electricity generation at global photovoltaic power stations decreased by 82%, with the price of components dropping by more than 90%. Moreover, the trend of price reduction in the photovoltaic industry has continued in recent years.

This means, with overall investment budget unchanged, the cost of photovoltaic generation has decreased, leaving more to be allocated to storage pairing.

II. Multi-technology Competition, Application Needs to Be Tailored to Local Conditions

JD Capital in the article "The Next Generation Battery Technology Competition: Who Will Lead the Trillion-Dollars Photovoltaic Industry?" mentioned the battle for next-generation battery technology routes in the photovoltaic industry is in full swing. Today, the same applies to the energy storage industry.

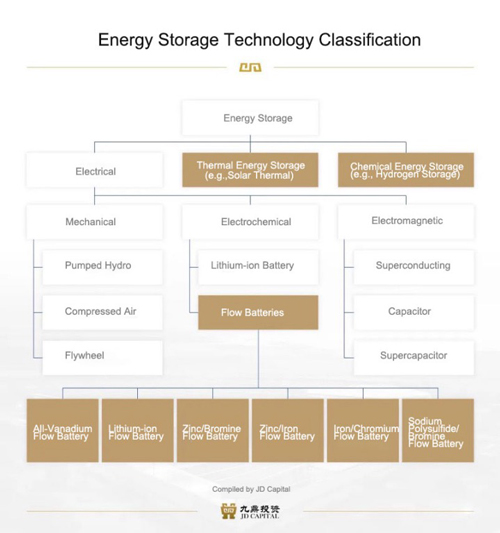

Specifically, based on different storage mediums, energy storage technologies can generally be divided into: electrical energy storage, thermal energy storage, and chemical energy storage. Among these, since electrical energy can be converted into chemical, electromagnetic, potential, kinetic, and other forms of energy, electrical energy storage technology thus further includes electrochemical storage, electromagnetic storage, mechanical storage, etc.

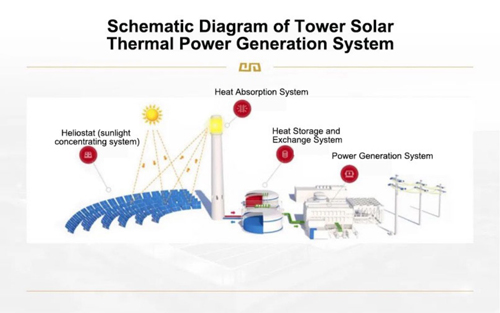

In the more nuanced storage sub-divisions, pumped hydro storage and concentrated solar power (CSP, mainly molten salt) storage have a longer history of large-scale application. However, global projects involving molten salt thermal storage are mostly concentrated in areas near the equator, such as Spain, Italy, the United States, South Africa, Morocco, and Chile. The application of molten salt thermal storage in China has only started to gain popularity in recent years.

Among various new types of energy storage, electrochemical energy storage is the most mature in development and the most applied commercially right now.

At present, most of China's electrochemical energy storage relies on lithium-ion battery technology. This technology had supports from consumer batteries and power batteries markets even before the development of the new energy storage, leading to continual rapid technological advancements across the entire industry chain. Manifested in the 97% decrease of lithium-batteries costs over the past 30 years.

Lithium-ion batteries are widely popular due to high energy density, but they also have unavoidable drawbacks: safety concerns and insufficient storage duration.

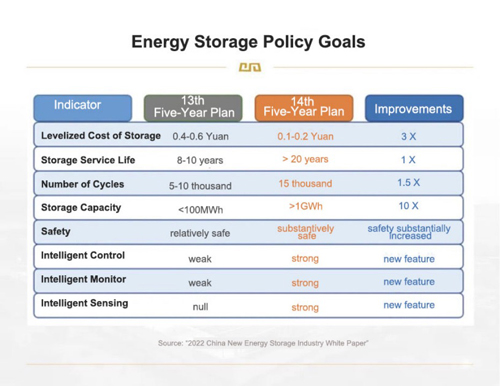

Looking at China's energy storage policy objectives: high safety, low cost, long useful life, large scale, high efficiency, and sustainable development mark the future direction of industry development. Especially safety, always the primary consideration in the choice of storage routes.

According to incomplete statistics, in the past five years, there have been 41 incidents of fires and explosions at storage facilities worldwide that have caused widespread social agony, 6 in the United States, 6 in China, 31 in South Korea, 1 in Belgium and 1 in Australia.

In 2022, the National Energy Administration explicitly stated that medium and large-scale electrochemical energy storage stations should not use ternary lithium batteries or sodium-sulphur batteries.

For lithium-ion batteries, their electrolyte is a flammable organic solvent. If the battery is subjected to internal or external circuits short out, overcharging, over-discharging, overheating, or compression, it may lead to thermal runaway. In an energy storage system, lithium-ion batteries are densely packed, thermal runaway in a single battery can cause a chain reaction throughout the system, ultimately leading to fires or even explosions.

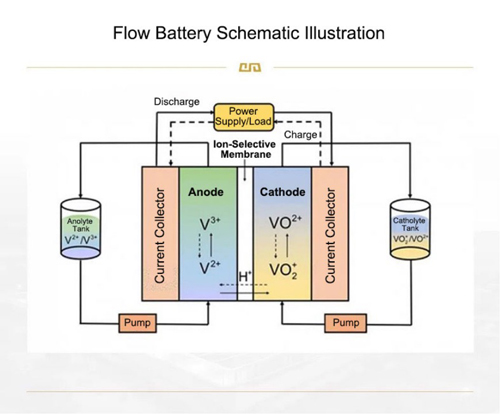

As the electrochemical energy storage product closest to pumped hydro, flow batteries have independently designed power output and storage capacity. They offer lower costs and higher safety when applied to large-scale storage, with storage times exceeding 8 hours and an overall lifespan of over 25 years.

Unlike lithium batteries, where lithium iron phosphate and ternary lithium dominate, flow batteries offer a greater variety with multiple technological routes and possibilities.

Currently, the most commercially advanced and technically mature flow battery is the vanadium redox flow battery. Vanadium redox flow batteries have over 20,000 charge-discharge cycles and a calendar life of more than 15 years (typically can reach 20 years), making them the longest-living among all types of secondary batteries.

Flow batteries have been around for nearly 50 years, but their application has long been hindered by shortcomings such as low energy density (only 1/10th of lithium batteries), bulky, limited applicable scenarios, and economical inefficiency

However, in recent years, the cost of flow battery storage systems has been rapidly decreasing.

Take the vanadium redox flow battery as an example, according to research by JD Capital, leading companies in the industry have had their deliverable prices decreased to about twice that of lithium battery storage systems. But taking lifespan, battery material recycling, and other factors into consideration, in the 4 hours and above long-duration storage sector, vanadium flow batteries perform better economically than lithium battery storage.

Interestingly, experts in the field have combined the advantages of lithium-ion batteries and flow batteries, into the lithium-ion flow batteries.

Depending on the chemical composition of the electrolyte, in addition to vanadium redox flow batteries and lithium-ion flow batteries, there are several other technological routes for flow batteries, including zinc/bromine, zinc/iron, iron/chromium, and polysulfide/bromine. These batteries offer different energy densities, operational temperature ranges, and numbers of charge and discharge cycles.

Beyond electrical energy storage technologies, thermal energy storage technologies such as concentrated solar power (CSP) thermal storage and chemical energy storage technologies like hydrogen storage also have their unique development potential.

For example, in arid and flat regions such as deserts, and semi-deserts, geological conditions do not permit pumped hydro or compressed air energy storage projects. Large power generation plants in these areas must operate under harsh environments, which pose a severe challenge for electrochemical storage solutions that are expensive, short in duration, and temperature sensitive.

In contrast, using molten salt as a heat transfer and thermal storage medium, CSP thermal storage meets the requirements for large storage capacity and long duration, they are economically efficient and can operate safely and stably for 25-30 years even under harsh natural conditions.

Overall, JD Capital observes that most novel long-duration storage technologies are still in their pilot stages. Depending on different applicable scenarios and geologies, the most suitable storage approach can be selected accordingly. As for which technological path will ultimately drive the development of the entire industry, remains to be seen over the next 5-10 years (or even longer) period.

III. Seize opportunities in niche segments, the strong grow stronger

Long-duration energy storage is still in the nascent stage of industrial development. No conclusive direction can be drawn among various technological routes, how should we look for certainty?

Currently, national policies have provided some guidance on certain niche energy storage technologies.

For example, the "Notice on Promoting the Scale Development of Solar Thermal Power Generation" issued by the National Energy Administration in 2023 aims to achieve an annual growth in solar thermal generation of approximately 3 million kilowatts during the "14th Five-Year Plan" period. It proposed to timely launch a new batch of solar thermal projects in combination with new energy plant constructions in deserts, semi-deserts and barren lands.

This means that if companies sought to build solar thermal power projects (which inherently include solar thermal energy storage) in these regions, they may receive more resources.

For those niche technologies that do not yet have clear policy support, it is necessary to delve deeper into the supply chain and seek opportunities within each segment.

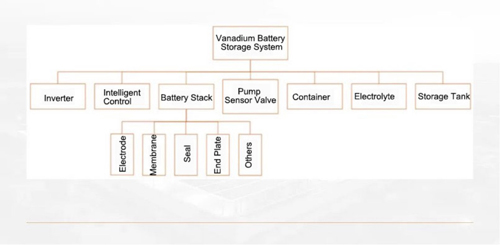

Take vanadium redox flow batteries as an example, the entire vanadium battery storage system mainly consists of the following parts: the cell stack, electrolyte, inverter, intelligent control system, storage tanks, containers, and pumps, valves, and sensors.

Regarding the core component of vanadium batteries—the cell stack—JD Capital believes there are opportunities for better-performing materials to replace the current electrode materials, and for membrane materials and bipolar plates (including both anode and cathode end plates) there exists room for cost reduction.

The main material for electrodes is carbon felt. Currently, the better-performing carbon felt manufacturers are concentrated in Japan, in China there are only around 5 manufacturers capable of producing carbon felt for flow batteries. The industry is moving towards using higher-performance carbon cloth as a substitute, but due to high technical barriers and major changes required for existing production lines, it has not been fully industrialized.

In terms of ion exchange membranes, the global vanadium battery industry mainly uses Nafion perfluorosulfonic acid resin exchange membranes from the American company DuPont. As the standard separator for all-vanadium redox flow batteries, it has high electrolyte stability. Currently, several domestic and foreign companies are innovating lower-cost membranes. With the gradual promotion of domestically produced ion exchange membranes, it is expected that the cost of these products will decrease by more than 30% within three years.

Compared to electrode and membrane materials, the technology barrier for bipolar plates is slightly lower. In the Chinese market, Chinese companies have gained about 90% market share, with the remainder held by German companies. The cost in this industry is expected to decrease by 30-50%.

Again, take solar thermal energy storage as an example, the industry for its construction is long, composed of four major segments: light concentration, heat absorption, heat storage & exchange, and power generation.

In JD Capital’s view, the solar thermal heat exchange sector involves various materials and equipment, i.e., molten salts, molten salt storage tanks, molten salt pumps, molten salt valves, salt melting equipment, heaters, heat exchangers, and insulation materials, presents many niche market opportunities.

Among them, in the molten salt industry, as China's solar thermal is still in its initial stage, international molten salt manufacturers, leveraging their collective advantages, have begun penetrating the Chinese solar thermal power market. Domestic molten salt suppliers, with the acceleration of domestic solar thermal projects, are also beginning to show local advantages.

The molten salts used in solar thermal power stations are usually mixtures of nitrates (such as sodium nitrate and potassium nitrate), which have the advantages of low melting point, high heat capacity, high thermal stability, and low corrosiveness.

Through research, JD Capital has found that the molten salt industry still has opportunities to improve product performance through technological innovation, such as reducing the chloride content (lightly corrosive) in nitrate products, thereby further enhancing the resistance to corrosion of metal equipment in energy storage systems and extending equipment lifespan.

The long-duration storage industry, including liquid flow batteries and solar thermal storage, does not lack battery system integrators.

In fact, according to JD Capital’s observations, long-duration energy storage is not an asset-heavy manufacturing industry but rather a light-asset, integrated mode of production. However, the threshold for integration is high: numerous materials and equipment are involved in a battery system, and enhancing their compatibility presents a difficult design challenge.

Moreover, the majority of proprietors in China's energy storage industry are state-owned utility corporations, typically only industry-leading companies can find ways onto their supplier directories. The more orders these suppliers get, the more engineering experience they accumulate, the faster their costs can be reduced, and the larger they can grow.

Therefore, the outlook of the competitive landscape in the long-duration storage industry will be such that not many players participate, and the strong will grow stronger.