Breaking the "big but not strong" : The breakthrough of the dual main lines of China's manufacturing investment

2025-06-13

Abstract:Domestic substitution + emerging high growth track

In the first quarter of this year, at the internal business strategy conference of JD Capital, Xing Xiaohui, the managing director of the Manufacturing Investment Department, shared his insights on investment in China's manufacturing sector. He noted that' domestic substitution 'and' emerging high-growth sectors' are key investment themes in the manufacturing industry at this stage. By conducting in-depth research and forward-looking studies in each sub-sector, we can identify truly valuable projects more quickly and effectively. By understanding the fundamental trends in industry development and accurately timing investment opportunities, we can fully capitalize on the growth potential of industries and companies.

The following is the transcript of Xing Xiaohui's speech on site:

Today, the development trend of China's manufacturing industry presents a pattern of scale advantage and transformation and upgrading needs. According to the statistics of the Ministry of Industry and Information Technology, China's manufacturing added value has maintained the first place in the world for 15 consecutive years, accounting for more than 30% of the global manufacturing added value, and is the cornerstone of global manufacturing development.

This achievement demonstrates that China's manufacturing system has established a solid foundation, but it also highlights the core issue of being' big but not strong. 'For instance, in terms of industrial structure, the domestic production rate of key materials and components is generally low. In the high-end photoresist sector, the domestic production rate is less than 1%, and while breakthroughs have been made in special materials like PPSU resin, the reliance on imports remains significant. This situation poses a potential risk to the security of the industrial chain. Therefore, we believe that China's manufacturing industry will continue to evolve and transform, generating numerous investment opportunities in the process.

Therefore, in this context, our current investment is mainly focused on two main lines: domestic substitution and emerging growth tracks.

Among these, domestic substitution is the primary investment focus. Under this theme, we focus on the existing market, particularly on alternative investment opportunities driven by the security and upgrading of industrial chains. It's worth noting that while the narrow definition of domestic substitution often refers to import substitution, our concept of domestic substitution also encompasses the replacement of old technologies with new ones and export substitution.

At JD Capital, we believe that domestic substitution is not merely about low-end replacement and imitation in the existing market. Instead, it involves establishing a comparative advantage on a global scale to gain a competitive edge. Regardless of the type of domestic substitution achieved, companies must ensure they achieve reasonable economic benefits and competitive advantages. Otherwise, such efforts may be labeled as 'pseudo-domestic substitution.'

Our second investment line is focused on the incremental market, focusing on emerging high-growth sectors with comparative advantages globally, such as energy transition, industrial Internet, AI and infrastructure.

Ⅰ. Precisely grasp the investment window

Around these two investment lines, how do we invest specifically? Which enterprises are more valuable to invest at what stage?

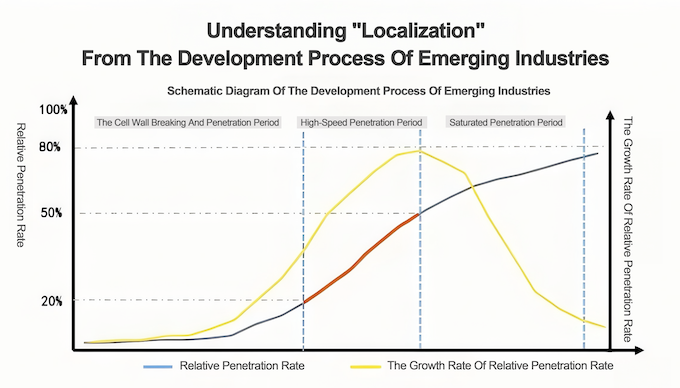

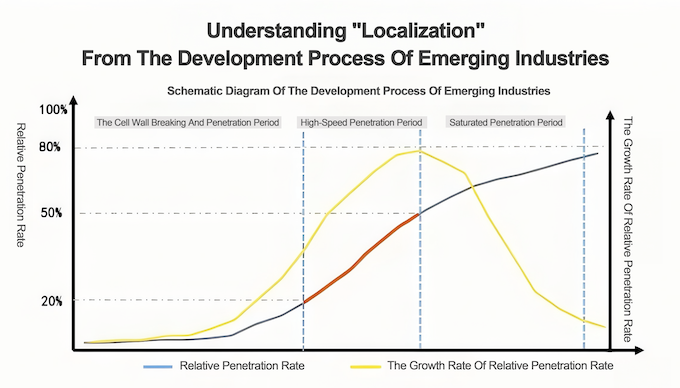

Taking domestic substitution as an example, I would like to use the model of emerging industry development cycle to illustrate that replacing "technology penetration rate" with "domestication rate" can be found that industrial development usually presents the following rules:

● The localization rate is 0-20%. After the industry achieves technological breakthrough, it will enter a long period of wall-breaking penetration, and the development speed is relatively slow, generally ranging from 3 to 10 years.

● The localization rate is 20-50%, the industry development accelerates, and enterprises obtain high growth. However, at the same time, the phenomenon of technology spillover gradually increases, the industry competition intensifies, the technological gap between enterprises narrows, and price competition gradually appears, and the gross profit margin decreases. Some enterprises are cleared, and the industry concentration degree increases.

● The localization rate is more than 50%, the industry competition is in a white-hot state, and large leading enterprises may be born through mergers and acquisitions.

Considering the development cycles and long-term growth potential of various sub-sectors, to fully capture the growth benefits during the high-speed penetration phase (20%-50%), we believe that when the domestication rate of a sub-sector reaches around 2%, it is worth initiating long-term tracking research. When this rate gradually increases from 2% to 10%, it will reach our ideal investment stage.

Why do we want to anchor the ideal investment stage at 2%-10%?

In today's investment market competition, when an industry reaches a domestication rate of 20%, it is usually considered relatively mature, and most people can understand it. The premium for the industry and companies starts to diminish. If you invest at this point, there is little chance of success. We must invest when most people have not yet noticed or understood the potential. Only then can we fully capitalize on the industry's and companies' growth opportunities and benefits.

Ⅱ. Domestic substitution —— breakthrough in the depth of the industrial chain

In terms of investment strategies in niche tracks, we have made detailed segmentation based on two main investment lines.

Focusing on the investment line of "domestic substitution", we can see from the entire manufacturing industry chain that China has almost completely experienced three industrial revolutions in the world's industrial history over the past 40 years, and its development path also shows a trend of gradually breaking through and improving from the downstream to the upstream along the industrial chain.

In the downstream of the industrial chain, due to the clear and large-scale demand in the terminal market, rapid growth, and high profit margins, coupled with less involvement in basic technology research and development, China has taken the lead in leveraging its cost advantages to develop in the terminal and assembly markets. For example, about 70-80% of global mobile phones, computers, and home appliances are assembled in China. In the midstream of the industrial chain, Chinese companies have also secured a significant share in the component sector, with their manufacturing capabilities for core components continuously improving.

However, in many links of the upstream of the industrial chain, due to the short supply chain and not located in China, China's cost advantage is not obvious, and the "neck-knot" problem is increasingly prominent. Today, it is almost impossible to break through simply relying on the "low cost" and "low price" model.

However, according to the laws of industrial development, once the industry's supporting facilities reach a certain level of maturity, domestic alternatives will gradually move upstream. Therefore, based on the logic of' domestic alternatives, there are still numerous investment opportunities in the upstream sectors of the manufacturing industry, such as new materials, components, and equipment. The previous accumulation in the terminal market, application scenarios, and mid-range manufacturing has now become the foundation for achieving domestic alternatives in various segments of the upstream industrial chain.

For instance, when it comes to new materials, 'domestic substitution' remains a critical issue for China's new materials industry. Data indicates that China's new materials industry currently accounts for a significant portion of global production, with growth rates far exceeding the global average, yet development is uneven. The industry is self-sufficient in mid-to-low-end materials but heavily dependent on imports for mid-to-high-end materials. In 2018, the Ministry of Industry and Information Technology (MIIT) conducted a survey of over 30 large enterprises nationwide, covering more than 130 key basic materials. The survey found that 32% of these materials are still unproduced in China, while 52% rely on imports.

According to our research, from the perspective of the life cycle of industrial development, China's new material industry is currently about 1/2~1/3 of that of foreign countries. That is, according to the calculation that it takes decades for new materials to be developed, promoted and finally applied, the gap between China's newly developed new materials and foreign countries may be more than ten years.

However, in terms of market size and growth rate, data indicates that the global new materials industry will reach $5 trillion by 2025, up from $3.3 trillion in 2021, with a compound annual growth rate of approximately 14%. China's new materials industry has seen an annual compound growth rate exceeding 20% over the past decade, and it is projected that the market size will reach $10 trillion by 2025.

This implies that the 'domestic substitution' of the new materials industry is a gradual process, not an overnight achievement. However, once technological breakthroughs are achieved, there will be significant room for growth. Additionally, it's important to recognize that the new materials industry is characterized as a' large but fragmented sector.' Despite its large scale, it comprises numerous niche markets that are small and scattered, with significant differences in Know-how, market channels, and core competitiveness among various products. Therefore, investing in new materials is destined to be a challenging marathon.

So, how can we find truly valuable projects in the field of new materials? We conclude that the core is to have a long-term perspective and be able to analyze the evolution of the competitive landscape of different markets from the perspective of market size, technology, cost and so on.

First, in terms of market size, new materials are often closely tied to downstream demand. The era when rapid macro market growth spurred the rise of upstream materials has passed. However, we observe that many industries, despite limited potential for exponential future growth, have a sufficiently large existing market (at least 3 billion yuan) and strong certainty. Therefore, companies that can quickly meet 'existing demand' (demand already validated by imported products) through technological breakthroughs and increase the localization rate still have opportunities.

Taking OCA (Optically Clear Adhesive) as an example, its market demand is closely tied to the demand for various panels, including mobile phones, tablets, and computers. According to our statistics, the industry's current total size is approximately 15 billion yuan, with less than 10% being domestically produced, and most products are mid-to-low-end. In recent years, several domestic companies have gradually absorbed advanced technologies by introducing technical teams and engaging in external acquisitions, and are expected to experience rapid growth in the future.

For more information, please click to read our investment industry research on "OCA".

https://www.jdcapital.com/en/news/4961d2f6d6e3f95821825a87885b951c

The existing market size of another category of industries is small, but the expected growth rate is very fast. In this kind of market, if an enterprise can meet the "replacement demand" and "create new demand", that is, new materials replace old materials and create new application scenarios, it is also a very good investment target.

Secondly, technology is crucial for new material enterprises to establish barriers. Without it, they are likely to fall into price wars and disorderly competition due to overcapacity. The choice of different technological paths directly affects the survival of the enterprise. We believe that the choice of different technological paths fundamentally depends on which path better meets downstream demand. However, this adaptability often changes with economic cycles and technological advancements.

For example, the supply and demand of upstream raw materials and their prices will affect the cost of new materials, which in turn affects downstream procurement. Improvements in technology or processes will also drive the adoption of a particular technical route. Therefore, when making investment decisions, it is advisable to evaluate technical routes on a 10-year cycle to some extent, thereby eliminating distractions and gaining a clear view of the "endgame."

Third, it should have high growth. The so-called high growth is mainly reflected in the following aspects: it has achieved technological breakthroughs, and has (or will soon) obtained the certification of mainstream downstream customers, is about to start mass supply, urgently needs to expand production capacity, and is about to usher in rapid growth.

Finally, in the long run, cost determines how far new material enterprises can go. Especially when the localization rate of domestic products reaches more than 20% in the subdivided industry, the technical level is not much different, and the competition intensifies, companies without cost advantages may be eliminated.

In addition to new materials, in the field of components at the upper end of the industrial chain, we also continue to follow the dual screening logic of localization rate and market scale, and continue to deepen research work in various segments.

For example, filters, as electronic components that can 'filter' specific frequency signals, can address the issue of signal interference between different frequency bands and communication systems. This sector is a market worth about 20 billion US dollars, with high technical barriers and a highly concentrated competitive landscape. Currently, the mid-to-low-end market in China has become extremely competitive, while the mid-to-high-end segment remains dominated by major manufacturers from the United States and Japan, with a very low rate of domestic production. There is a significant demand for domestic alternatives.

Our research has revealed that Chinese companies face two primary challenges in the filter industry: first, they are constrained by the patents held by major foreign companies, which is a core issue; second, the cost, as Chinese filter manufacturers generally have low yields, leading to high manufacturing costs. However, during our recent visits, we found that some companies have developed new technological approaches. These innovations not only help them bypass patent restrictions but also significantly improve yield and reduce costs. Once their products achieve downstream certification, the new technological approaches can be widely adopted, leading to rapid growth for these companies and a swift increase in the industry's domestic production rate.

For more information, please click to read our investment industry research on "Filters".

https://www.jdcapital.com/en/news/4e2a47efe8efa74a0cce5258192d3057

Ⅲ.Emerging high-growth track-overtaking on the curve, reshaping the competitive landscape

In view of the second investment line, we take new energy as an example to illustrate. At present, China's new energy industry has a very strong competitive advantage in the world, but in recent years, due to extreme internal competition in the industry, large-scale and systematic investment opportunities have been very few.

However, in the long run, we believe that there are still structural investment opportunities in some relatively segmented areas due to technological innovation and iterative demand. For example, perovskite, solid-state battery, composite copper foil and carbon ceramic composite and other innovative directions.

In our view, global companies often have the opportunity to stand on the same starting line when faced with new opportunities brought by technological innovation. Whoever develops a mature technology route first and produces more cost-effective products will be the first to occupy the market and reshape the global competitive landscape.

For example, in lithium batteries, copper foil serves as a carrier and current collector for the negative electrode's active material, facilitating the collection and conduction of current. China is a leading producer of traditional copper foil. However, the new composite copper foil, featuring a' copper-polymer-copper '' sandwich' structure, offers advantages such as safety, low cost, and high energy density. This new type of copper foil is expected to replace traditional copper foil, and Chinese companies are actively entering this market.

Our research found that some domestic enterprises have obtained orders from downstream customers, but because they have not found a mature way to reduce costs, they do not have cost advantages compared with traditional copper foil, so large-scale production has not been realized. However, the market space of composite copper foil is broad, and the production enterprises with competitive advantages deserve attention.

Furthermore, our estimates suggest that the cost of equipment accounts for as much as 50% of the composite copper foil supply chain. The price, yield, and production capacity of the equipment are key factors in reducing costs and increasing market penetration for composite copper foil. Therefore, once the technology matures and enters the intensive testing phase at downstream battery factories, even if the competitive landscape remains uncertain, the equipment sector may benefit first.

However, it should be noted that, unlike "laboratory technology", we believe that truly valuable new technologies must be "real technology": relatively mature and capable of mass production. Small-scale production and mass production are two different things, and mass production puts forward higher requirements on capital, talent, supply chain management and other aspects of enterprises.

In addition, the new technology must also have economic benefits, and the products produced should be cost-effective, so that downstream customers will be willing to buy, and there will be "real demand" in the market.

Taking the ballpoint pen core steel, which has been a topic of discussion in recent years, as an example, its reliance on imports is not due to technological limitations but because the lack of a robust supply chain ecosystem makes localization economically unviable. In reality, Chinese companies have managed to achieve mass production of ballpoint pen core steel, but this requires significant time to recondition machine tools and integrate with ink (both of which are sourced from foreign suppliers). More importantly, the demand for pen core steel is relatively low; unless a company holds a substantial global market share, it cannot sustain profitability based solely on domestic demand.

Finally, we summarize our core thinking under the two investment lines of "domestic substitution" and "emerging high growth":

● Forward-looking industry research is the premise. In-depth industry, good research in each segment of the industry, can find truly valuable projects faster.

● Identify the investment window and choose industries with a relatively low rate of domestication. Once the domestication rate surpasses a certain threshold, the industry enters a period of rapid growth, accelerating development and leading to high growth for companies. As technology spillovers increase, competition intensifies, and the technological gap between companies narrows, price competition becomes more prevalent, and gross profit margins decline. At this point, some companies are forced out of the market, leading to increased industry concentration. Therefore, investment opportunities often emerge before the critical point is reached. However, it's important to note that the critical points vary across different industries.

● It is very important to judge the market size and growth rate. We believe that the market size should reach at least 2-3 billion yuan to support the development of 2-3 companies. In addition, industries with fast growth rate of market size have more potential.

● The scarcity of enterprises is the key. In terms of technological breakthrough, mass production and cost reduction, are only a few 1-2 enterprises able to do it? The essence of the domestic substitution market is still competition, and enterprises must have their own moat.

● Be cautious of high valuations in uncertain situations. When new technologies are poised to replace older ones, and the technical pathways and downstream demands are unclear, high valuations often indicate an excess of bubbles. Companies currently at the top may find it difficult to recoup their substantial initial investments if they fail to develop mature technological pathways, potentially becoming a heavy burden.

Ⅱ. Domestic substitution —— breakthrough in the depth of the industrial chain