New logic of Chinese intelligent manufacturing investment : Technology substitution, AI integration and industrial transition

2025-05-20

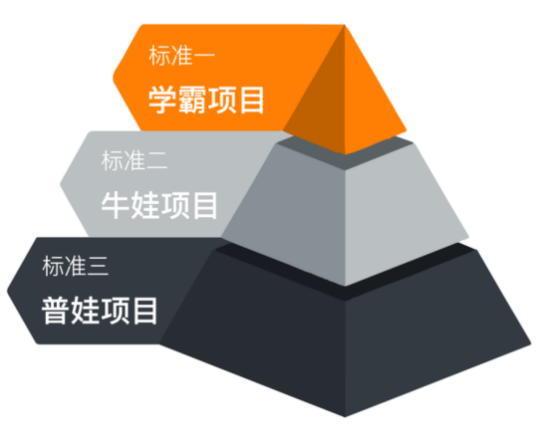

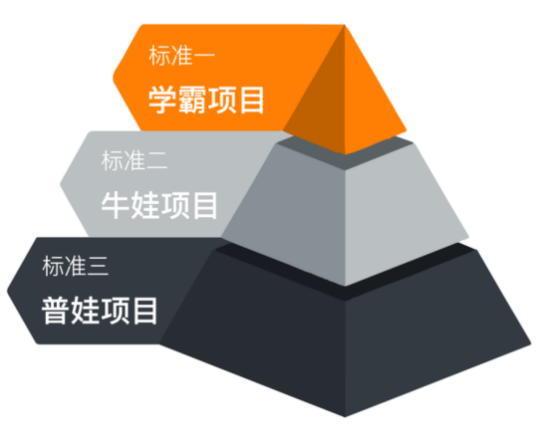

Abstract:Three levels of investment framework + three investment logic

In the first quarter of this year, at the business strategy conference of JD Capital, Wang Yong, managing director of the manufacturing investment department, shared his thoughts on investment in the field of intelligent manufacturing.

The "three-level framework" investment system he proposed, relying on the stratified screening mechanism of "scholar-child-bull-child-common child" projects, not only strengthens the safety base of the investment portfolio, but also systematically improves the probability of capturing investment opportunities brought by the outbreak of new technologies.

The following is a summary of Wang Yong's speech at the scene :

Ⅰ. Three levels of investment framework + three investment logics

Today, intelligence has become a key variable in reshaping the global manufacturing competition landscape.

In this context, on the one hand, we will continue to adhere to the concept of cost-effective investment in the future. But more importantly, we will continue to increase our research efforts in emerging industries, especially in frontier fields such as artificial intelligence and advanced manufacturing.

Based on this "dual-track" investment logic, we summarize the investment framework for the coming period of time into a three-level standard system:

● Standard One, "Scholar Project": Targeting technologically advanced emerging companies, their technical paths must align with global mainstream development trends. This is combined with the cost-performance advantage of Made in China, requiring the industry to have high-tech barriers and the company to possess ample technical reserves. Existing customers can be mid-tier clients, but they must have passed targeted validation and bulk supply testing by a few top-tier clients.

● Standard Two, "Talent Project": Focus on companies with the potential for secondary growth, capable of seizing industry trends and achieving leapfrog development. The target customer base should cover leading enterprises in the industry and establish stable supply relationships. For example, companies that excel in at least three out of the five key areas of manufacturing——people, machines, materials, methods, and environment—despite potentially higher valuations, are worth betting on due to their rapid growth potential.

● Standard Three, "General Project": Targeting mature enterprises, this is also the type we have invested in more frequently in the past. These projects generally have lower valuations, clear differences between primary and secondary markets, high operational certainty, and no substantial obstacles to listing. For such projects, we primarily focus on core financial indicators. If they can maintain a continuous growth rate of over 10%, it would be even better.

In terms of specific industry layout, we have established three core investment logic:

● First of all, the investment opportunities in the field of new materials should be deeply explored along the import substitution path, focusing on the segments of polymer materials and inorganic non-metallic materials, especially the special functional materials which are in the critical period of domestic production rate improvement;

● Secondly, grasp the opportunities of manufacturing reform, focus on the layout of new energy industry chain, automotive electronics and robotics, and pay attention to the structural investment opportunities brought by technological iteration

● Third, we will deepen our efforts in the equipment manufacturing industry, focusing on core components of robots, laser equipment and upstream supply chain, and explore hidden champions with precision manufacturing capabilities.

Ⅱ. AI+ Manufacturing: Deep integration, reshaping the boundaries of performance

Today, artificial intelligence is undoubtedly a hot topic. However, it should be pointed out that the innovative effect of AI technology on manufacturing has also begun to form an important investment window period, and the application of related technologies is reshaping the traditional production process and supply chain system.

From a technical architecture perspective, an artificial intelligence system, in simple terms, is built on deep neural networks. It achieves machine learning functions and decision support through multi-level information processing via input layers, hidden layers, and output layers. According to the latest industry forecast data released by IDC, the global AI market size will exceed 2.3 trillion RMB by 2025, with the Chinese market reaching 1 trillion RMB. By 2027, the global market size is expected to grow fivefold.

Currently, the global industrial chain is characterized by a bipolar dominance between North America and China, which is directly related to the two major language families. We believe that in the future, the development of the global artificial intelligence industry will still be led by China and the United States, with the core competitive elements focusing on three pillars: computing infrastructure, data resource accumulation, and algorithm innovation. The upstream foundational layer provides data and computing support, the midstream leverages comprehensive technological innovation to empower downstream application layers, and downstream demand drives technological iteration and infrastructure upgrades in reverse.

AI can be concretely expressed in the physical world in various forms, such as robots, smart cars, vehicles, AR/VR glasses, and mobile terminals. However, among these application scenarios, we believe that areas like intelligent robots and intelligent vehicles (Robotaxi, Robobus, autonomous driving) are likely to achieve large-scale commercialization first. For example, Tesla's Optimus Prime robot has a planned production target of 5,000 units by 2025, with an annual production capacity goal set at 50,000 to 100,000 units by 2026.

Today, in the process of manufacturing investment, why do we think AI is also important?

Analyzing China's manufacturing sector, the consensus is that it is "large but not strong," particularly in terms of hardware precision and quality stability, which still lags significantly behind countries like the United States and Japan. The emergence of AI, from VLM (Vision Language Model) to VLA (Vision-Language-Action), has reduced the requirements for hardware specifications by enabling backpropagation mechanisms, convolutional neural networks, recurrent neural networks, and multi-layer perceptrons to perform computations and processing again. At the same time, leveraging China's manufacturing advantages, this approach is more suitable for mass production.

Therefore, in the process of deep integration of artificial intelligence and manufacturing industry, we have formulated a phased investment strategy internally.

In the early stages, we found that the current robot industry chain and automotive industry chain are highly integrated in terms of components. For example, many parts of Tesla's Autopilot robot come from its automotive component suppliers. Therefore, we focus on electric vehicle suppliers that can simultaneously create synergies with the robot industry chain. As a fundamental sector, automotive components are relatively mature; at the same time, they can provide prototypes to robot customers or collaborate on R&D, opening up greater growth potential in the future. Such companies are very much in line with our "Standard Two" for "Top Talent" projects, capable of riding the wave to achieve technological transformation and achieve secondary growth in performance.

When the industry reaches maturity and robot products enter mass production, we will pay more attention to secondary and tertiary suppliers of key customers. We will focus on Tier1 and concentrate on core components such as numerical control systems, high-precision sensors, and intelligent actuators around Tier1 suppliers. Breakthroughs in these areas will directly determine the performance boundaries of intelligent equipment.

Ⅲ.Auto industry chain: new demand, new pattern

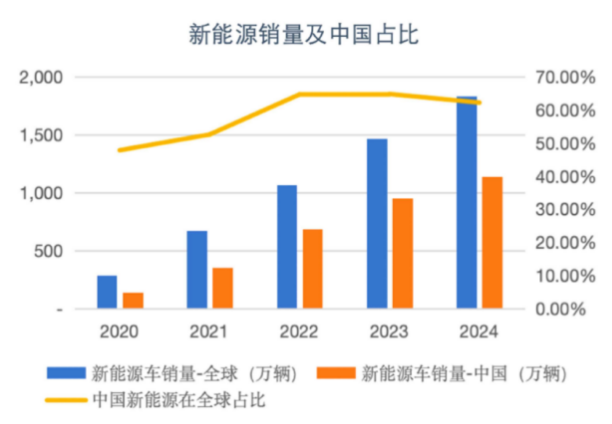

Although it is widely believed today that the overall global car market may not see much change in sales over the next decade, we see that there are still many changes in the industry as it evolves.

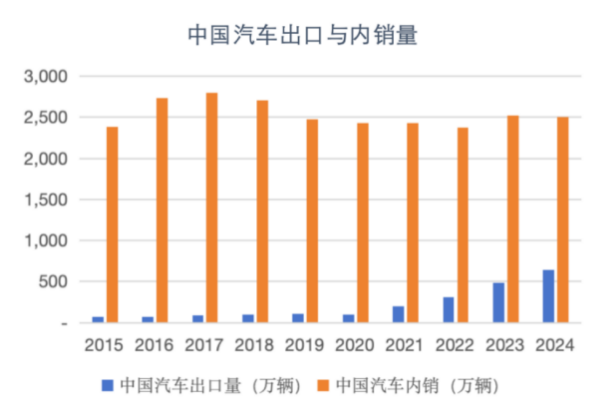

First, China's auto exports are experiencing a dual breakthrough in both quantity and quality. Data shows that in 2024, China exported 6.41 million vehicles, with 32% increase. The unit export value rose from $14,000 in 2020 to $18,300 per vehicle in 2024, with the price of new energy vehicles increasing from $14,000 to $22,000 per vehicle. Therefore, if component manufacturers can keep up with the pace of automakers' overseas expansion, they will have the opportunity to expand into new markets and achieve new growth.

Secondly, in 2024, the annual wholesale share of independent brands will exceed 65%. The market share of China's independent brands is still breaking new highs, and the head effect is beginning to show.

Third, the market below 150,000 yuan has been largely dominated by domestic brands. The price range of 150,000 to 350,000 yuan is currently the most competitive segment, where leading domestic and new entrants are gradually eroding the market share of joint ventures through their advantages in new energy and intelligent driving. In the price range above 350,000 yuan, the competitive landscape is relatively better, with joint ventures and BBA still holding the majority share.

These changes all mean that the future automotive industry has the opportunity to drive the growth of related supply chain enterprises. If Chinese parts companies can seize the structural opportunities under the changing situation, they are expected to rise and win in the new round of competition.

We believe that for some established companies in the traditional automotive industry chain, if they can keep up with the changes of the intelligent and electrified era and increase the proportion of new energy vehicle orders, their advantages will still persist. After more than four decades of development from scratch, Chinese automotive parts companies have accumulated certain advantages in some areas, such as automotive glass, interior and exterior trim, sunroofs, aluminum die-casting, and thermal management. Due to the strong localization characteristics and high demand for nearby services in these fields, many local established companies have already developed relatively maturely during the era of gasoline vehicles.

More importantly, in areas with higher technical barriers, such as engines, transmissions, and automotive electronics, Chinese companies generally started late and have always been in a catch-up position technologically; due to safety concerns, traditional automakers pursued stability, leaving new suppliers with few opportunities. Therefore, during the era of gasoline vehicles, these sectors were dominated by international giants, and the process of domestic substitution was relatively slow. However, in the age of intelligent electric vehicles, this situation is being changed due to the evolution of core components.

Take the "three major components" of fuel vehicles: engine, gearbox and chassis. The first two have been replaced by motor, electronic control and reducer; the chassis, which supports and installs the engine and other components, is also being redesigned. In these fields, Chinese and foreign companies are almost on the same starting line today.

In addition, we believe that even in the parts sector where some overseas giants once held a dominant position, it is unlikely to see a single dominant player in the future. This is because during the era of gasoline vehicles, the automotive industries of Germany and Japan nurtured domestic parts companies like Bosch and Denso as they grew, leading to less intense competition within the same niche.

And today, competition in the automotive parts industry is even more intense. Especially for Chinese parts companies, which have always been in a highly competitive environment, the future global industry landscape will be more fragmented compared to the past. Focusing on core components of the intelligent electric vehicle era, Chinese companies have opportunities in areas such as domain controllers, LiDAR, wiring harnesses, actuation systems, chassis, and suspension, all of which are undergoing significant changes.

Ⅳ.Other key segments: structural opportunities in the evolution of the industry

In addition to AI and the automotive industry chain, many segments that we have been tracking and studying over the past few years are also giving birth to new changes. These segments are embracing structural opportunities through the triple evolution of "technology innovation + scene breaking + domestic substitution".

■ Take the laser equipment industry as an example: a breakthrough opportunity for domestic substitution

We have seen a lot of projects in the field of laser in recent years, and we have done a lot of industry research around high power and high power lasers. In fact, at present, China has basically realized the comprehensive domestic substitution of low power, medium power and high power laser equipment, and the investment opportunities in related fields are relatively limited.

However, in the field of micro and nano processing equipment, we believe there are still good investment opportunities. This is because, from the perspective of laser development trends, micro and nano processing equipment is evolving in three directions: high power, narrow pulse width, and short wavelength. In particular, ultrafast lasers (such as picosecond and femtosecond lasers) still face technical challenges in achieving both high power and high stability simultaneously.

The main issue with current domestic lasers is that while some products can improve processing efficiency, their performance stability is insufficient. The core value of narrow pulse width technology lies in addressing thermal damage during the processing. For example, in nanosecond laser drilling processes, materials like PCBs still suffer from significant carbonization damage, whereas picosecond/femtosecond lasers can significantly enhance processing accuracy.

From the perspective of industrial chain structure, the upstream mainly consists of optical components, including field lenses, beam expanders, galvanometers, and optical lenses, with a relatively low rate of domestic production. The midstream involves laser manufacturing, while the downstream is laser equipment integration. In terms of industry scale, the domestic laser equipment market was approximately 30 billion yuan in 2015, growing to 78 billion yuan by 2021. We anticipate that the micro-nano processing sector will double in size by 2026.

We believe that the micro and nano processing sector holds significant potential for nurturing many companies with market values in the tens of billions. This is because, taking global leaders like Germany's Trumpf and America's IPG as examples, these companies all have revenue scales ranging from 10 to 20 billion. In China, existing listed companies include Han's, Dier, Raycus, Jepth, and Haimo Star. As the industry as a whole enters the era of billion-dollar revenues, it may support market capitalizations reaching the 300 billion level.

Following the extension from lasers to laser equipment, we also focus on LDI (Laser Direct Imaging). Currently, the downstream PCB industry in China is highly localized, but the upstream core equipment is still dominated by overseas suppliers such as Belgium's Orbotech and Japan's ORC, collectively holding about 65% of the market share. Although the global LDI equipment market is limited, with a scale of several billion yuan, its growth momentum is significant. On one hand, this is due to the accelerated pace of domestic substitution (the current domestication rate is less than 10%), and on the other hand, industry demand growth remains within a range of 15-20%.

In similar industry sectors, we also focus on CNC machine tools, consumer-grade additive manufacturing, industrial robots, and special materials. However, the investment logic in specific sub-sectors varies greatly. For instance, regarding the CNC machine tool supply chain, we pay attention to the variable opportunities brought by AI+. In contrast, for industrial robots and special materials, we concentrate more on the incremental opportunities resulting from the explosive growth of the robotics industry.

On the whole, there are rich and diversified investment opportunities in the field of intelligent manufacturing. With the continuous evolution of the global manufacturing competition pattern, China is at a critical period of moving from "manufacturing power" to "manufacturing power", which is not only a challenge, but also a huge opportunity.

In the future, Chinese companies are expected to leverage technological innovation, cost advantages, and vast market potential in areas such as new materials, new energy, automotive electronics, and robotics to secure a more prominent position in the global industrial chain. In this process, investors will not only reap substantial economic returns but also inject strong momentum into the transformation and upgrading of China's manufacturing sector, achieving a win-win situation for both industry development and investment returns.

In the current era of rapid technological iteration and accelerated industrial upgrading, we will continue to maintain sharp insights, stay abreast of cutting-edge trends, conduct in-depth research on industry dynamics, and flexibly apply investment strategies. We must not only be adept at identifying "scholar projects" in the wave of emerging technologies, capturing high-growth opportunities brought by technological breakthroughs; but also pay attention to the secondary growth potential of "outstanding projects," as well as the stable returns of "general projects."