In the future, digital service providers of the manufacturing industry in China should be rooted in specific areas

2023-04-04

Today, the size of China's digital economy has grown from $1.59 trillion to over $6.52 trillion; digital infrastructure, such as 5G and cloud computing, is achieving explosive growth; large consumer and industrial sectors are also exploring the use of digitalization to create redundancy, improve resilience and protect supply chains in the wake of challenges. In the future, digitalization will be an unstoppable and definitive driver.

In the WISE2022 China Digital Innovation Summit hosted by 36Kr, Li Jianli, Managing Director of Advanced Manufacturing of JD Capital, discussed the pain points and investment opportunities in the digital industry with many investors.

The following is an excerpt from the sharing from Li Jianli:

1.The macro environment of the digital industry

If the implementation of the enterprise is not in place at this time, the result of its digitalization will become two types: online to go a set of digital systems, offline and a set of paper processes. Initially, a set of work, coupled with digitalization, becomes two sets of work so that people think digital is useless, increasing the workload of everyone.

When discussing investments, we often discuss hot tracks and new concepts. JD Capital does not intentionally pursue these things but will look at the macro environment because equity investment must first examine the policy and economic environment to see 5-10 years‘ future.

In 2021, the 14th Five-Year Plan (the outline of China's 14th Five-Year Plan for National Economic and Social Development and Vision 2035) devoted four separate chapters to clarify China's strategic goals and direction to promote digitalization. China sees the transformation and upgrading of the digital economy as a critical window of opportunity for the next ten years, and the digital economy will be a core component of China's economic transformation. The plan states that by 2025, the value added to China's core digital economy industries will increase from 7.8% to 10% of GDP.

After the country proposed the "14th Five-Year Plan" in the "Government Work Report" at the beginning of this year, it also made a highly strategic plan for the development of the digital economy and digital infrastructure construction and digital transformation of the 5G system, including accelerating the development of the industrial Internet, fostering and growing digital industries such as integrated circuits and artificial intelligence, and improving the technological innovation and supply capacity of crucial software and hardware.

In addition, the National Development and Reform Commission also addresses the digital transformation challenges of enterprises and provides policy guidance and support from three aspects: problem-oriented, goal-oriented, and result-oriented.

The various encouragement policies show that the state attaches great importance to digital transformation.

Digitalization is also critical for China's economy to take the next step of transformation and upgrade and take another step up.

Digitalization will usher in a good development window in the next 5-10 years.

Let's take a look at the development of China's digitalization industry.

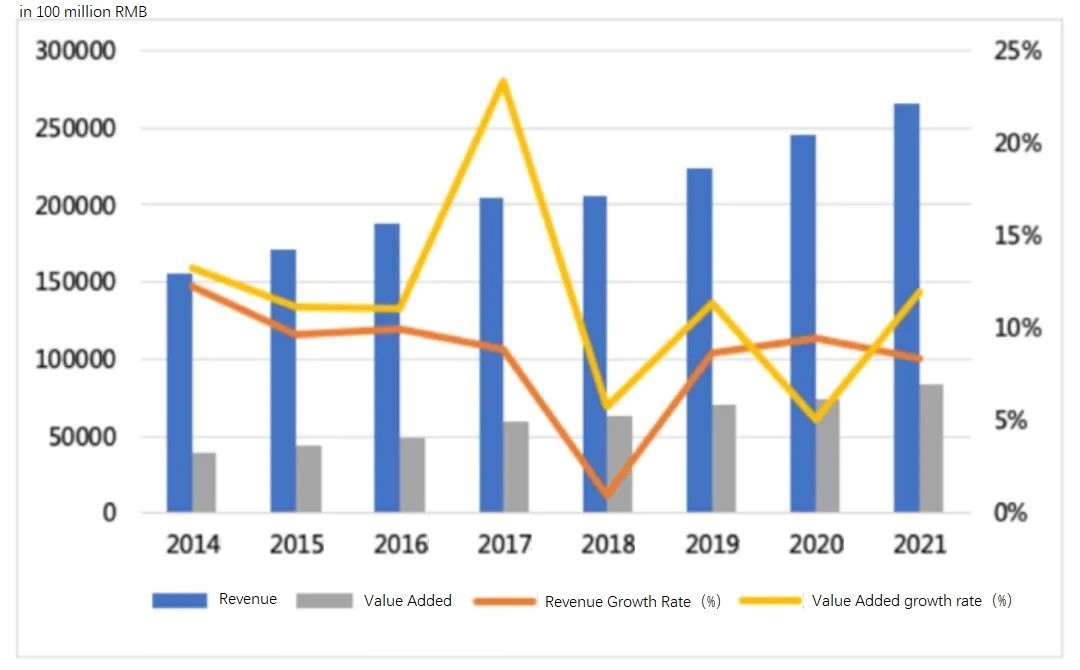

The China Academy of Information and Communications Technology has calculated the revenue, value-added, revenue growth rate, and value-added growth rate of China's digital industry from 2014-2021. The data shows that the added value of China's digital industry in 2021 is 8.4 trillion yuan, an increase of 11.9% over the previous year and a 7.3% share of GDP. The digital industry is again large and growing fast.

(Data source: China Academy of Information and Communications Technology, China Digital Economy Development Report (2022))

From a structural point of view, the digital industry structure maintains a softening trend. The digital industry structure is still mainly in ICT (information and communications technology). The ICT industry, for investors, is the former TMT industry. At the same time, the software and Internet industries continue to increase the shares of the overall digital economy.

Although the digital industry is huge now, the major part is in ICT, software, and Internet industries, and the digital share of the real intelligent manufacturing industry still needs to grow. Digitalization is still relatively in the early stage of application in the manufacturing industry.

2.The overall state of enterprise digitalization

As far as digitalization in the manufacturing sector is concerned, there is a huge gap between different segments and different companies.

More industrial enterprises, which may have been able to mechanize and automate their equipment in the past, still need to do an excellent job in cost and energy management during the whole production chain. Because there are many machines and equipment involved, and some data are not so easy to capture, there are still problems regarding equipment manufacturer interfaces and communication protocols.

The next step for these industrial enterprises is using the data captured and refined to understand what energy, how much time, and what parameters are used in the production process through data empowerment to optimize the production process.

Industrial manufacturing, such as the automotive industry, started with joint ventures to connect with the world in the early days. Many business owners believe that it does not matter whether they make money or not.

As a result of the early attention given to financial digitization, companies are generally early in digitizing their financial management.

In the entire industrial production process and various other areas of industry, the degree of intelligence and digitalization are relatively low; medium and large enterprises first financial ERP module used, many enterprises in OA (Office Auto, Office Automation) and other paperless office systems digital degree is also relatively high.

After the Chinese government put forward the action plan "Made in China 2025" in 2015, Chinese factories have gradually done intelligent transformation and digital factories from the original mechanization and automation. It is only in the last 7-8 years that digital factories have developed relatively fast.

Of course, the action of the big factories is far ahead of the small and medium-sized factories.

Like Foxconn, it was in a highly labor-intensive industry. It is relatively difficult for companies to transform digitally because the data collection progress needs to be automated. But in 2011, Foxconn's helmsman, Guo Tai Ming, proposed the "Million Robot Plan." Now, in Foxconn's entire production process, the proportion of machines and automation is very high, so it has the primary conditions to realize the digitalization of the manufacturing process.

Huawei, for example, asked the most advanced international enterprises to help it plan the management and R & D process more than 20 years ago, which is great for its digital enhancement. The digitalization of large enterprises such as Midea and Gree is doing very well, and traditional heavy machinery enterprises such as Sany, Zoomlion, XCMG, etc., are also constantly improving their digitalization and automation capabilities.

We see that the degree of digitalization of big manufacturers is more complete than others because the scale of enterprises is larger, and the strength of digitalization cost they can afford will be higher. Moreover, many head companies are now global companies, supplying products globally. The talents and competitors are also global, so their global vision is higher. From this standpoint, the head enterprise can see the help and improvement of digitalization and know its own needs.

And for many small and medium-sized enterprises, a system may need to spend hundreds or tens of millions of dollars and feel pressure on the cost. Moreover, more than how much the digital effect on performance improvement, confidence, and cognition is also needed.

To sum up, the overall status of enterprise digitalization is that digitalization in financial management and other aspects is relatively complete, but the digitalization in business processes is still relatively rudimentary; large enterprises are doing better, and small enterprises are accelerating the process of catching up.

3.Problems faced by the digital industry

There are no digital conglomerate companies in China because there is still a need for digital applications and service providers for digitization.

Many business decision-makers have heard about digitalization, but why do companies want it? What do they want to achieve? What kind of cost should they pay? Their knowledge of these things needs to be clarified. They either drag their feet and keep hesitating about spending the money or go on with a snap of the head. However, the internal management and change of the enterprise need to keep up, and the digital effect does not reach expectations.

More is needed for decision-makers to understand digitalization; there is still a need for more specialized digital talent within the company.

Enterprises' digitalization, especially for SMEs, feel a little pressure on cost, and their expectations in digitalization on business capability improvement need to be more explicit. They need to figure out whether to start with the business or where to start, and the whole planning still needs improvement. Furthermore, many enterprises have gone digital but may have yet to keep up with synchronized management, cost reduction and efficiency improvement, and organizational improvement.

Digitalization is not the end of a system, but a management tool and means, according to the enterprise's pain points, problems to do the corresponding enhancements through the digital way to solve these problems more efficiently. Many companies see an excellent vision for digitalization but must get it right.

The digital service providers in the financial ERP software, like UFIDA, Kingdee, and other companies, have done a great job. However, their digital products in the manufacturing industry still need to be more challenging to apply because the manufacturing industry is a highly diverse type of sub-sectors, products, and models.

There are relatively more small and medium-sized enterprises in the manufacturing industry, and their demands and processes, as well as the capabilities of existing personnel, are very diverse. Suppose many service providers need to understand the downstream owner's processes and capabilities clearly. In that case, they need to know what digital tools they can provide to match, not to improve the owner's processes and make the manufacturing enterprises' people really understand and use digitalization well, and understand, not resist.

Many scientists and doctors also come to do digitalization, and their ability to provide software is robust. However, for manufacturing enterprises, each process is different. Their understanding of manufacturing links and non-standard claims is not necessarily in place because they need to know all the enterprise's production processes and process parameters, which will lead to the refinement of the data alone, but not the better use of these data.

There is a high capability and cost threshold for service providers to implement digital transformation in enterprises. Very often, they use individual machines to collect the data and display it on a big screen, which looks beautiful. The whole management is transparent at a glance. However, there is no optimization of the management process and process production process of the enterprise. In other words, the enterprise's digitalization has yet to be done.

The manufacturing industry has a relatively high degree of non-standard, the scale is generally small, and there are problems with the discourse of upstream and downstream enterprises.

Often, the upstream is too strong, and the service providers need to be more professional to persuade the upstream. They compromise with each other at inappropriate points but make the whole digital execution worse, a problem commonly faced by the digital industry.

4.How companies can better promote digitalization

Digitalization must be a handful of projects; otherwise, it will not be promoted within the enterprise. As for whether we should first focus on organizational change or execution, this is a question.

In digitalization, a hand has to think clearly about what problems the actual operation of the enterprise has encountered and which can be solved and improved by digitalization. The thinking and decision-making process means the enterprise must make some organizational management and model changes.

In this process, enterprises must also do in-depth communication and discussion with digital service providers.

Digitalization can easily be trumpeted as advanced. However, the digitalization of enterprises must be deeply combined with the needs, pain points, and processes of enterprises. Especially for industrial enterprises, the effect of digital transformation varies significantly from enterprise to enterprise, from management mode to management mode, and from product to product. The digitalization of enterprises is not only the upgrade of technical solutions but also the transformation and upgrade of enterprise management, organization, and process.

The process of digitization is similar to the process of enterprise consulting and management. Through deep communication and in-depth research with service providers, enterprises will know where the problems are, know what kind of digital means to improve the management and organization of enterprises, and finally form precious digital solutions in this process to reduce costs and increase efficiency for enterprises, provide better service and product quality stability for customers, and achieve the purpose of digitalization.

Enterprises do not digitize for the sake of digitization but to improve the competitiveness of enterprises, which is an essential goal of enterprise digitization.

If, in the process of digitization, we can solve the problems of the enterprise and improve the management efficiency and organizational capability; the following will face the implementation problem.

Especially in the early stage of digital change, all people are used to the previous model; when digital change, some industries may require front-line personnel to know the system can operate, unlike the previous simple can write the number, fill out a form on the line, at least to know simple computer operation. In this way, many people with learning abilities in using digital tools will face problems, making some resist.

This creates a situation that the digitization itself is well done. However, the execution needs to be put in place, making digitization not only ineffective but may also have the opposite effect.

Digitalization is a handful of projects; enterprises should pay attention to the organizational changes in the digitalization process and emphasize the execution, the enterprise problems discussed more clearly and suitable, and then implement it well.

In addition, giant companies like Huawei and Midea have specific IT capabilities. However, most enterprises, especially industrial ones, need help building IT teams. As their enterprise scale is small, they can't afford the cost of a self-built IT team, more through the cooperation with some professional digital team to digitize, and at the same time, can learn from the experience of some more excellent leading enterprises in the same industry to do digitalization.

After all, the degree of segmentation in each field is relatively high, and only a few digital suppliers understand the industry's problems. If it is the home appliance industry, the United States, with which suppliers, their experience will be a good reference for the whole industry. Improving the success rate of digitalization and reducing the cost of digital implementation is also a big help.

Therefore, the digitization of an industry usually starts from the leading enterprise first because it is significant in scale, has higher management costs, is more challenging to manage, and has a more robust demand for digitization. If the leading enterprises do so, "dragon two," "dragon three," and other enterprises also want to follow the advanced experience of the industry to run and learn from each other so that the whole industry development is faster.

5.Investment opportunities in the digital sector

Digitalization of the large industry is good, and the policy is supportive. The development of the whole economy is in a critical period of transformation and upgrading, the digitalization of large factories is relatively complete, and small and medium-sized enterprises are following up.

The digitalization sector still has many investment opportunities. If the existing problems can be solved, companies will get rapid development.

From the perspective of the pan-digital economy dimension, from standard digital tools to some non-standard digital solution providers, there will be excellent companies in different fields.

Although manufacturing companies are small and scattered, they will have better development opportunities if they can be rooted in specific sub-sectors, refine their experience reserves, make some benchmark cases, and deeply integrate with the industry.

Like semiconductor EDA (Electronic design automation, electronic design automation), industrial design, simulation, and other software localization rate is meager. The demand in the country is enormous. With the big international environment, domestic companies will be raising standardized tools and software.

Now there are also some office companies listed. However, in the industrial field, the demand is more specialized, more precise, and the single higher value of the enterprise; we think that in the future will have better development opportunities.

Some digital service providers focus on niche areas and optimize and process energy management, process parameters, production links, and power consumption peaks and valleys of related enterprises. It is an excellent digital direction we see.

For example, digital service providers can save 3%-5% of energy consumption in the production process of high-energy-consuming enterprises, such as steelmaking and glass, by monitoring all energy data and optimizing process parameters. They are highly energy-consuming enterprises, and such savings are already significant.

Companies deeply involved in segmentation will also get good development opportunities if they can match the digital supply capacity and demand of each field, large category, and extensive industry and then expand gradually to each segment.

Some service providers can provide innovative digital applications, such as the combination of software and hardware, and provide services to enterprises more digitally and intelligently; they will also get good development.

Now, there is a small and scattered situation of digital enterprises, they must need capital to help them to have rapid development, and we are also focusing on these areas, hoping that capital and the digital industry can be deeply integrated so that enterprises in the digital transformation and upgrading opportunities in China can get better development, and we also get better investment opportunities.