Forty Years navigating the tightrope, the Chinese auto-component sector poised to forge ahead?

2023-12-06

Abstract: the greater the change, the greater the opportunities

How can investments both go with the “flow” – identifying trends and opportunities, while at the same time be grounded in “principles” – abiding by norms and patterns? Currently, China is transitioning from a “large” manufacturing country to a “powerful” manufacturing country, amidst this transition, what are the trends and principles?

As a PE firm specializing in equity investments for over a decade, JD capital has served many outstanding Chinese companies in various fields. In the “Empowering Chinese Manufacturing” column, we attempt to review and summarize our past investment experiences across various industries, and continue to serve the new generation of “Made in China” enterprises through equity investments.

In this issue, we focus on the automotive components industry.

In early November, a debate between Huawei and Xpeng Motors, brought vehicle AEB technology into the spotlight.

AEB (Autonomous Emergency Braking) is a basic function of intelligent driving, mainly concerned with the ability to “stop safely”

When Huawei release its ADS 2.0 automated driving system, it stated that the highest stopping speed for AEB has been increased to 90 km/h, a major highlight for the new Wenjie (AITO) M7 model. Xpeng Motor’s Chairman and CEO, He Xiaopeng, however, said during media interview that “our competitor talked about AEB, I think it is 99% false”.

Afterwards, He Xiaopeng and Huweri’s executive director, CEO of Terminal BG, and Chairman of the Huawei Intelligent Automotive Solutions BU - Yu Chengdong, engaged in several rounds of “virtual” confrontations.

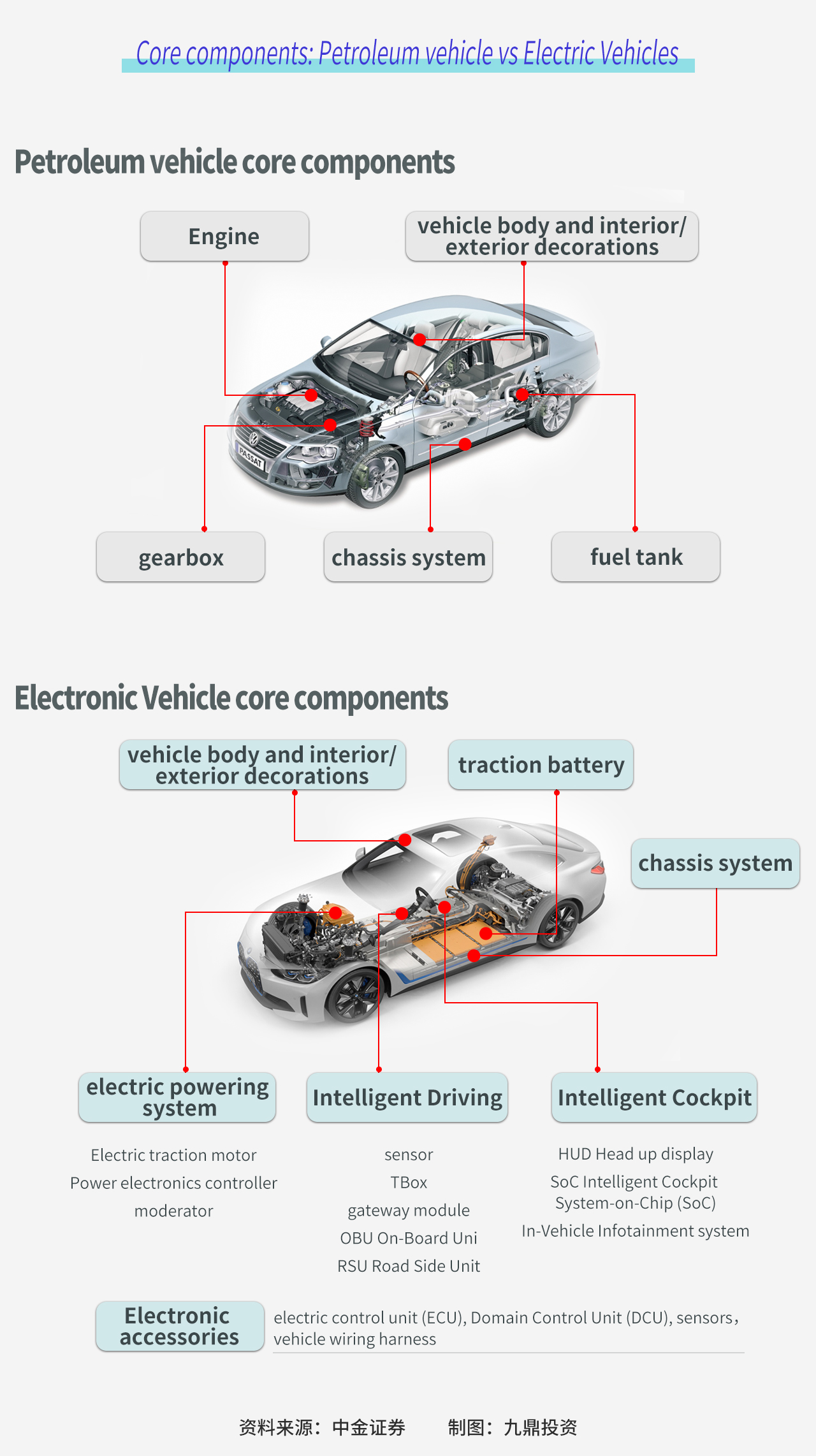

Underlying the squabble, these two vehicle enterprises are battling for influence in the mainstream narrative of intelligent driving. At the same time, it reflects a shift in competitive barrier of the automotive industry. The “three electric systems” (battery, electric motor, and electric control system),along with software and hardware capabilities surrounding intelligent driving and intelligent cockpits, are becoming core elements of “super mobile intelligent terminals” – electronic vehicles.

In face of changing core elements of automobiles today, can the upstream components industry in China give rise to world class companies?

JD Capital has been focusing on investment opportunities in the upstream automotive industrial chains since 2010, for investments in car body components related companies: Dongguan Modern Metal & Precision, Sichuan BMT Welding Equipment and Engineering etc; for investment in traction battery related industry chains: Btr New Material Group (835185), Guizhou Anda Energy Technology (830809) etc.

In this article, we aim to unravel our past investment experiences, analyse current state of the industry and attempt to answer:

● With changes to the structure and competitive barriers of the automotive industry, what new opportunities have emerged in the upstream auto-components sectors?

● For PE investments, which are the “real” opportunities worthy of attention, and how to identify those possessing degrees of certainty within a rapidly evolving industry?

1. Opportunities: Three major structural growth opportunities for Chinese component firms

In the past 40 years, the development of China’s auto components sector has been driven by growth in downstream sales of vehicles. Compared to mature overseas markets, however, it still exhibits relatively low total output value, lacks renowned lead firms, and highly dependent on imported core components.

But now, electrification and AI are reshaping the global automotive market structure. Domestic Chinese brands are relentlessly capturing new market shares, “lead firm effects” (accumulated advantage) are beginning to show, bringing in more opportunities for related industrial chains to grow. If Chinese component firms can seize the opportunities brought by structural transformation, they will be poised to rise in a new round of competition.

Opportunity 1: New changes, New demands

After over forty years of development from scratch, Chinese auto components firms have accumulated certain advantages in sectors such as glass, interiors, sunroofs, aluminum die casting, door panels, bumpers, etc., these sectors have strong localization attributes, and a high demand for service proximity. During the petroleum era, many domestic established enterprises have matured.

We believe that if these established enterprises can keep up with the changes brought by new era AI and electrification, increases the portion of new energy vehicle sourced orders, their advantages will continue.

In other sectors with higher technical barriers, like engine, gear boxes, vehicle electronics, Chinese firms are late comers, technologically constantly in “catch-up” mode; due to traditional, well established automakers concerns for safety and reliability, very little opportunities exist for start-ups. Thus, during the petroleum era, these sectors have been dominated by international monopolies, and the process of import substitution relatively slow.

However, in the era of intelligent Electronic Vehicles (EVs), due to changes in core components, the stranglehold is being broken.

Take the “three major components” of traditional petroleum-powered cars – the engine, gear-box, and chassis – as examples, the first two have been replaced by electric motor, electric control units, and moderator; and the chassis – being the foundation, loaded with engine and various other components – is being redesigned.

As a result, traditional component giant’s monopolistic positions are being weakened, today, foreign and domestic enterprises are at the same starting point.

Additionally, we estimate, even in sectors previously dominated by foreign monopolies, it is unlikely similar (monopolistic) situations will re-emerge in the future.

This is because, during the petroleum era, German and Japan automakers actively assisted, nurtured their own domestic component enterprises, giving rise to Bosch and Denso, there existed little to no competition within the same sub-segments.

Therefore, the core component surrounding the era of intelligent EVs, we believe, Chinese enterprises have opportunities in areas with significant changes, such as domain controllers, LiDAR, wire harness, steer-by-wire, and chassis. Of which, taking the domain controllers and LiDAR as examples:

● Domain Controllers: with the EVs incorporating more and more functions, distributed domain controllers are evolving towards centralized ones. Take vehicle body domain controllers as examples, the penetration rate in petroleum vehicles are less than 10%, but for EVs, penetration rate has reached 60%.

The framework evolution provides opportunities for Chinese firms to challenge established foreign ones. This is because Chinese firms have certain advantages over foreign giants in terms of assorted R&D capabilities (including response speed, cooperative level, R&D technology), cost, product quality and delivery capabilities.

Overall, factors like the increase in new energy vehicle sales, the rise in the localization (domestically produced) rate of automotive electronics, domestic brands’ market share rising, will all drive the growth of Chinese enterprises in the domain controller sector. According to our internal research, market size of vehicle body domain in China, 2023 is roughly 2 billion RMB, the market size of broader vehicle body control unit sector where Chinese firms participate as tier 1 suppliers, is roughly around 45 billion RMB, with future growth anticipated.

● LiDAR: due to high costs and technology immaturity, there is currently no consensus in the industry on whether LiDAR will be widely incorporated in vehicles in the short term.

However, our research finds, Chinese automakers have already seen a wave of LiDAR incorporated vehicles in the second half of 2022. Currently, Chinese automakers are the world's largest users of LiDAR.

We believe that despite the large initial R&D investment, the technologies have not yet been standardized or popularized, many innovative enterprises remain unprofitable. The cost of LiDAR has begun to decrease significantly in recent years. Considering its absolute advantage over pure vision in technology and performance, LiDAR still has the opportunity to complement "millimeter-wave radar + ultrasonic + camera" equipment to make up for the shortcomings of vision technology.

Moreover, the LiDAR market is large enough, once the products are mass-produced, the current industry structure still has a chance to renew.

However, being optimistic in its future value does not translate into investment opportunities right now. In practical investment decision-making, on one hand, we pay attention to the timing and scale of LiDAR's mass production applicable to vehicles. Underlying this, need to predict realizable pathways to cost reduction, and the same time consider the progress of related laws and regulations for auto-pilot and the maturity of the upstream and downstream LiDAR industry chain.

on the other hand, the number of legitimate orders remains a key factor in assessing the investment value of a company. In the future, LiDAR firms that can form in-dept collaboration with major automakers, continuously receive large quantity orders still have opportunities.

Additionally, we observe that some seemingly traditional components like seats and lighting are also undergoing transformation. Take seats as an example, new energy vehicle makers use seat heating, ventilation, massage, and electric adjustment functions as selling points, continuously increasing the value of individual seats.

Traditionally, the seat market has been highly concentrated, with the top five overseas giants occupying about 75% of global market share. Taking into account stable client-relationships and long development cycles in this sector, it is not easy to upset the status quo. However, in the era of intelligent EVs, with the development of Chinese independent car brands, Chinese seat suppliers can still have opportunities if they can play to their strengths in assorted R&D, cost control, and quality consistency.

Opportunity 2: Cost reduction

We observe, in some auto component sectors, Chinese firms have reduced production costs through technological breakthroughs in key processes, made innovations in materials and techniques, subsequently increasing the market penetration of their products. Once the applicable product becomes widespread, new opportunities will emerge along the related chains.

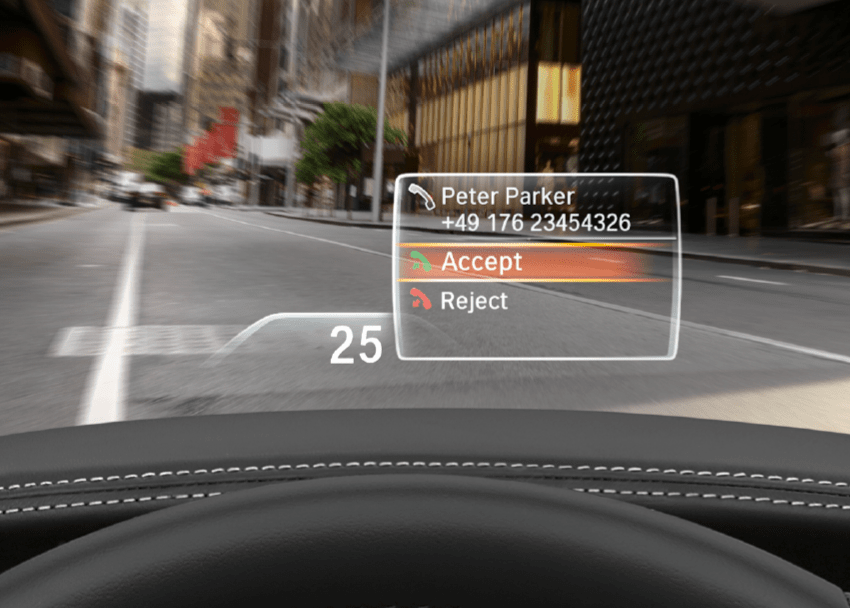

Air suspension and vehicle head-up displays (HUDs) are typical examples. Take HUD as an example, costs are already going down, If the market share of HUD expands, the upstream demand will also continue to increase.

For example, different from ordinary automotive glass, on many new energy vehicles, to prevent HUD images from casting double-image on the windshield, one way is to add a wedge-shaped PVB film inside the windshield’s inner layer, making the glass thicker at the top and thinner at the bottom. Additionally, some windshields use transparent nano-films laminated inside, which enhances the brightness of the main image and eliminates double images. The demand for these new "film" products on new energy vehicles signifies new investment opportunities.

Opportunity 3: globalization

Today, the overseas expansion of Chinese vehicles is achieving breakthroughs in both quality and quantity.

According to the data from the China Association of Automobile Manufacturers, in the first half of 2023, China exported 2.341 million vehicles, an increase of 76.9% yoy. Chinese automakers are no longer confined to the traditional export model of finalized vehicles; more and more automakers are starting to build factories overseas, integrating local resources, and completing the transition from "globalization" to "localization".

Therefore, automakers have placed further demands on auto-component firms, expecting them to also have the ability to go overseas, to provide assorted services and respond locally, reducing supply chain uncertainty. We posit that if auto component firms can keep pace with automakers going overseas, they have the opportunity to expand into overseas markets, achieving new growth.

More importantly, in the overseas market, although Chinese auto-components firms bear the same operating costs as local suppliers, they have more obvious advantages in communication and providing Chinese automaker assorted services.

2. Supply chain collaboration changes: new roles, new patterns

As power and technology continue to evolve, the collaborative relationships within the automotive supply chain are also undergoing change.

We observe, today, that in the process of deconstructing and reinventing the entire automotive industry structure, a new ecosystem that better fits logic of the new industrial chain is emerging: "Tier 0.5" suppliers — their products cover a wider range, have higher integration, and involve more collaborative design with automakers. Hence, the emerging Tier 0.5s are better tailored to the market needs of the electrification era and are more likely to occupy key positions in the industry chain.

Meanwhile, accompanying the rise of China's new energy automakers, a new batch of component manufacturers incubated by the automakers are also developing.

1) Supply Chain to "supply circle", finding Tier 0.5

In the past, the automotive supply chain presented a tiered delivery structure. Among them, Tier 1 suppliers had the most bargaining power, supplying assemblies, and modules directly to automakers, and involved in collaborative R&D and design.

Now, this tiered system is increasingly unable to meet demands of automakers.

One reason being, in terms of R&D efficiency, “supply chain” has turned into “supply circle”, for example, an intelligent cockpit system may require multiple suppliers to collaborate and develop in parallel.

Second, in terms of collaborative design, from software to hardware, new standards and industry structures are changing dynamically on day-to-day basis, and automakers also require certain suppliers to collaborate in development, in need of joint explorations.

Third, in terms of supply chain control and cost management, Tesla has brought about cost reduction and intense competition. Automakers can effectively reduce costs by integrating multiple products' components procurement. Tesla also further enhanced control over its supply chain, endeavoring to master the technology of core components, the demand for related tier 1 suppliers have much reduced compared to the past.

Therefore, we observe, the number of tier 1 suppliers are dropping, and their status are beginning to disintegrate. Some Tier 1s are being "downgraded" to Tier 2, moving into an awkward market position. A portion of these firms may be more and more distant from automakers, face decreased market demand sensitivity, reduced pricing power, and decreased gross margins.

On the other hand, some Tier 1s are "upgrading" to Tier 0.5, forming closer cooperative relationships with automakers. They expand their capabilities beyond their core products, integrate other components, and evolve from component supplier to “systems supplier”. As a result, Tier 0.5 not only have more say in products but also occupy more important positions in the industry chain, from an revenue perspective, increasing income form assembly activities as well.

We find that this separation in trajectory is already commonplace, the key to achieving "upgrades" depends on whether core products have sufficiently high barriers, and whether their expansion capabilities are up to par. i.e., whether their core products have aspects of irreplaceability to automakers; whether the threshold for expansion is low enough when extending their core products to other products.

For example, a component firm that provides vehicle door inner panels, if they can holistically assemble ambient lights, sensors, speakers, and horns within the door panel, allowing automakers to install them directly for use, can then become Tier 0.5 suppliers with relative ease, as ambient lighting eventually end up on the door panel anyway. Conversely, companies that only provide ambient lighting and other individual products would find it harder to integrated assembly.

2) Automaker incubated firms: becoming independent is the inevitable path

Among the global automotive component giants, many of which were gradually spun off from business units of petroleum automaker giants, such as Denso, Aptiv, and Faurecia. Because in the early stages of the automotive industry development, when faced with a blank supply chain environment domestically, automakers had no choice but to enter the field themselves, explore potential suppliers, jointly forge a supply chain system, and complete most manufacturing work in house. Towards later stages of development, due to the operational pressure on automakers, some component departments were gradually spun off.

Today, we see a similar trend in China. In the early stage of electric vehicles, related industry chains were not mature, Chinese automakers could not find suitable suppliers, out of supply chain safety and costs concerns, chose to produce some components themselves. For example, BYD faced a vacuum in domestic “three-electric” production when it started producing electric vehicles and had to build its own supply system. Afterwards, BYD gradually spun off companies such as Fudi Battery and Fudi Power.

So, for these component firms, which ones have the opportunities grow into world-class enterprises in the era of intelligent electric vehicles?

We believe that independence is the necessary path to achieving leapfrog development; serving only one automaker is not enough to sustain a world-class supplier. The important challenge is whether the component firm has enough strength to participate in market competition after spinning off from automakers.

Take Denso - the world's second-largest auto-component company - as an example, its predecessor was Toyota Group's internal electrical components department, initially tasked foreign procurement and related testing work. During World War II, due to Japanese government's mandate for automakers to use domestic parts, coupled with a sudden surge in demand in the Japanese auto market, Toyota lacked time to find suitable quality suppliers domestically, thus, decided to build its own factory. Establishing the foundation for Denso's independent production.

After the war, as Japan's economy teetered on the brink of collapse and the auto industry entered into a slump, Toyota, under sales pressure, decided to spin off the electrical components department, establishing Denso. A pivotal moment for Denso's destiny was its collaboration with Bosch in 1953. Bosch first reached a technical assistance agreement with Denso on hydraulic devices production, then, in component sectors such as diesel engines, Denso were able to absorb and innovate on top of Bosch’s technological foundations. Gradually, Denso established its own advantages and expanded its business lines, breaking away from the confines of exclusively supplying to Toyota, and moved towards having a global presence.

Denso

Therefore, for purpose of investment, it is crucial to identify auto-component firms with real strength to step out of the automaker' shadow. Here, we can divide the different component segments into two categories:

Segments with a high degree of product standardization. These products are highly structured with clear quality metrics, can easily be centrally produced. Therefore, economies of scale creates investment value.

Segments with a stronger demand for customization, where customer perception is more apparent, and the degree of product standardization is lower. In this field, hence, the number of cooperative automakers and designated models determine the future growth potential of the enterprise.

3. Investment judgement: How to find “real” opportunities amidst transformation?

1) Industry size/growth rate

Firstly, the size of the components sectors depends on the demand from downstream automakers. Only when the downstream demand is definite, the market relatively large or when growth rate is significant, can component enterprises have the opportunity to concentrate production, improve production efficiency, and raise profit margins.

Therefore, in our investments, we primarily focus on the industry size and growth rate. For example, if a single product of a firm can capture 5% market share, taking China's passenger vehicle market as reference - over 20 million units (23.56 million units in 2022) – the volume of vehicle has this product installed has the opportunity to reach 1 million units. This also means more bargaining power for the enterprise in the industry chain.

In fact, in 2015, one of the important judgments we made when investing in Dongguan Modern Metal and Precision, a precision die-casting firm, was that the market size for aluminum alloy die-castings would continue to grow under the trend of vehicle weight reduction. At the time, we had already witnessed a large number of automakers using more aluminum alloy parts instead of steel to reduce vehicle weight. More importantly, around 2010, we began to focus on the trend towards vehicle electrification, believing in the approaching era of EVs, to increase mileage, this demand would become even more pronounced.

2) Technology barriers

Once the industry size/growth rate reaches a certain level, how to find more competitive firms within?

The most critical factor is technological barriers, which can be manifested in breakthroughs in production techniques, collaborative design capabilities, and R&D efficiency etc.

Taking a precision mechanical component enterprise we once invested in as an example, in the rotor compressor sector (used in air conditioning), it achieved domestic substitution by breakthroughs in production techniques and replacing the Japanese and Korean suppliers. At the same time, through integrated production capabilities, it can better control quality and reduce production costs. Another invested company, Chenghan Baoma, a vehicle body systems integrator, took system integration to the extreme and achieved a flexible production line capable of switching between six vehicle models.

In addition, collaborative design capabilities are also a manifestation of technical strength and in the current stage, it is one of the new requirements proposed by automakers. Because the standards and structure in the automotive industry is undergoing dynamics changes on a daily basis, automakers and suppliers needs to perform collaborated designing. For instance, Dongguan Modern Metal & Precision, with decades of experience, has the capacity to innovate in collaboration with automakers in the designing stage, that contributes to new possibilities of overall vehicle performance improvement.

In addition, in the era of smart EVs, R&D efficiency is ever more important. The time it takes from design to mass production for a car has significantly shortened, posing higher demands on response speed of suppliers, requiring them to improve R&D efficiency while ensuring quality.

3) Product quality and delivery capability

Due to safety concerns, automakers always had stringent requirements for product quality of component manufacturers. It is only after a long period and extensive validation, can a components manufacturer truly enter an automaker's supplier system.

Entering the era of electrification, however, automakers have raised new demands for the delivery capabilities of component manufacturers.

Facing fiercer competition, electric vehicle companies, in pursuit of cost control and achieving faster iteration, are taking zero-inventory management one step further. Tens of thousands of components suppliers are required to deliver goods every few hours and maintain continuous timely deliveries. This is a test of the component enterprise's core capabilities.

Moreover, compared to petroleum vehicles, new energy vehicles are more prone to producing "hot-selling models," but very remain uncertain before hitting the market. Therefore, if there is a surge in sales, the production of components must keep up. This has led automakers to demand greater mass production capabilities from component enterprises, not only to prioritize existing models but also have capacity to meet new demands.

4) Cost control capability

For a century, cost control capabilities has remained a key indicator in measuring competitiveness of a component manufacturer.

Taking a factory we recently visited as example, the company's main products are relatively mature automotive components. The company is extremely strict in material management, from the moment of procurement, every material is entered into the ERP management system, implementing full-process control. Meanwhile, the company adheres to industry standards, through recycling and re-using a portion of its material wastes, achieved maximum material utilization in multiple production stages. It is through such detailed management, companies’ costs have been reduced, and have for a long time maintained gross margins above the industry average.

Overall, underneath the wave of AI and electrification, China's new energy automotive brands have caught the window of opportunity for growth and consolidation, and the underlying "new forces"- component manufacturers are also facing a decisive moment. Amidst industry-wide restructuring, we will continue to focus on Chinese firms with growth value.