CXO:the Pharmaceutical “Shovel-Sellers”,will they create world-class companies?| JD Investment Insights

2023-12-04

In the early days of reform and opening, China’s cheap labour costs and attractive investment conditions made it the ideal destination for the re-location of lower-tier supply chain activities from advanced economies such as Europe, U.S., Japan and South Korea. This marked the beginning of China’s contract-manufacturing industry.

Just like the electronic industry has given birth to globally renowned contract manufactures such as Foxconn and TSCM, the pharmaceutical industry has its own group of “shovel-sellers” – commonly known as CXOs, or pharmaceutical outsourcing services. CXO are often seen as the “thermometer” of pharmaceutical industry development.

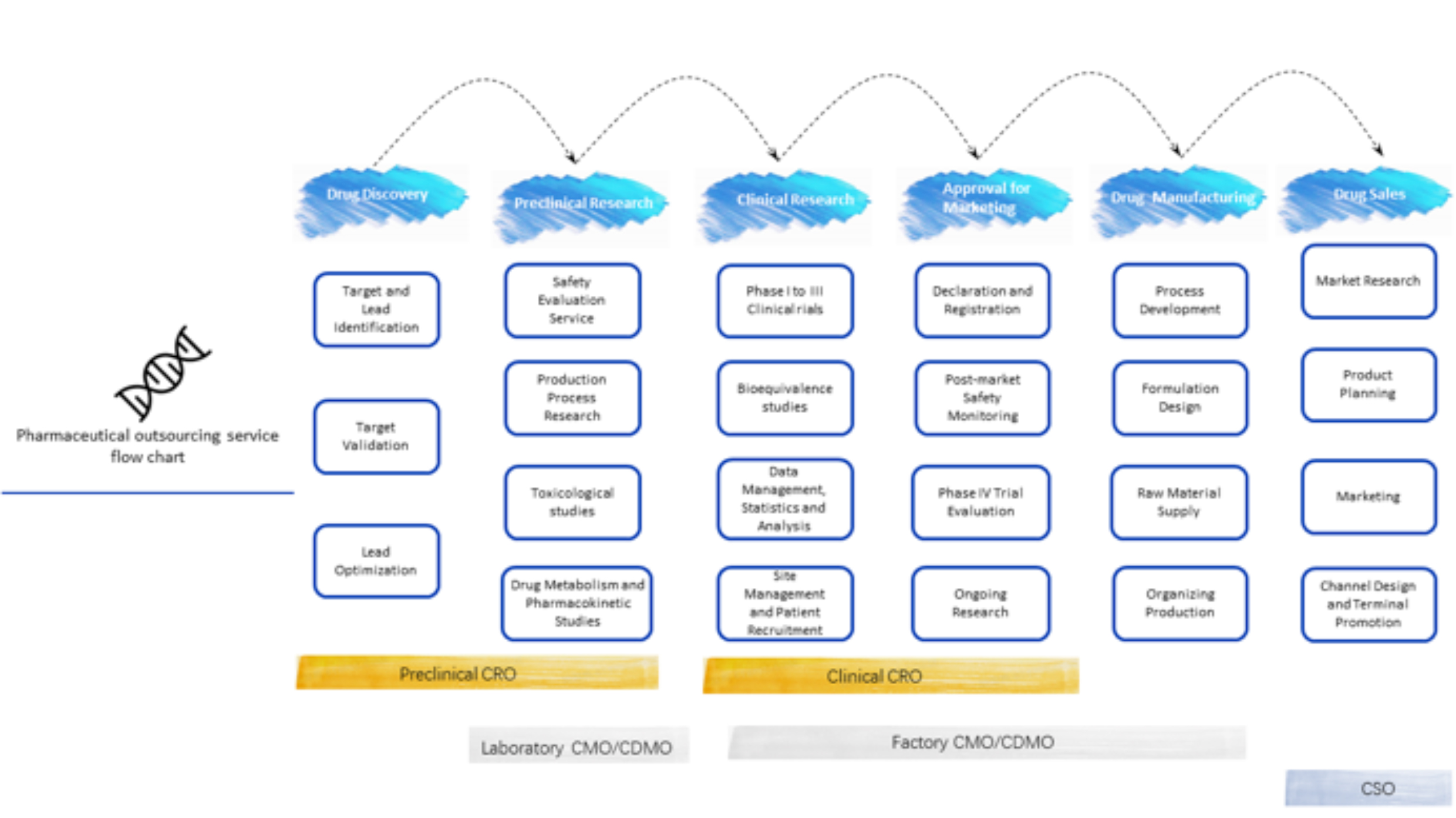

CXO generally encompasses CROs (Contract Research Organizations), CMOs/CDMOs (Contract Manufacturing/Contract Development and Manufacturing Organizations), and CSOs (Contract Sales Organizations), serving in the research, production, and marketing/sales stages, thus, can be simply understood as the outsourcing of R&D, production, and sales.

Over the past two years, Chinese CXO industry has shown roller-coaster-like developments: reaching a peak in capital market mid-2021, followed by several turbulent falls, until a rebound in Q4 2022.

Amidst which, the turbulent declines were driven by changes in both domestic and international climates.

Domestically, e.g., in Nov 2021, the CDE (Centre for Drug Evaluation of the National Medical Products Administration) issued a report (《中国新药注册临床试验现状年度报告(2020年)》) in which warned against the homogenization in development of innovative medicine (“me-too” type patents).

Internationally, in Feb 2022, the U.S. Department of Commerce listed 33 Chinese companies, including WuXi Biologics(药明生物), on its “Unverified List” - restricting these companies from importing controlled products from the U.S.. In the same year, the U.S. government signed an executive order directed at enhancing American bio-tech production and research, aiming to expand American bio-manufacturing capabilities and reduce dependence on Chinese manufacturing in this sector.

Even so, new players continue to enter into the industry. Among them, are companies that had shifted from raw materials/API manufacturing to CDMO, e.g., Purolite Pharmaceuticals (普洛药业),Jiuzhou pharmaceuticals(九州药业), Menova (美诺华) etc; as well as innovative drugs companies that started offering CDMO services through subsidiaries between 2021 and 2022, e.g., Sansheng Pharmaceuticals (三生制药),Fuhong Hanlin(复宏汉霖), Xinda Bio (信达生物).

Taking a long-term perspective, JD Capital believes, China’s CXO industry has both certainty and growth potential.

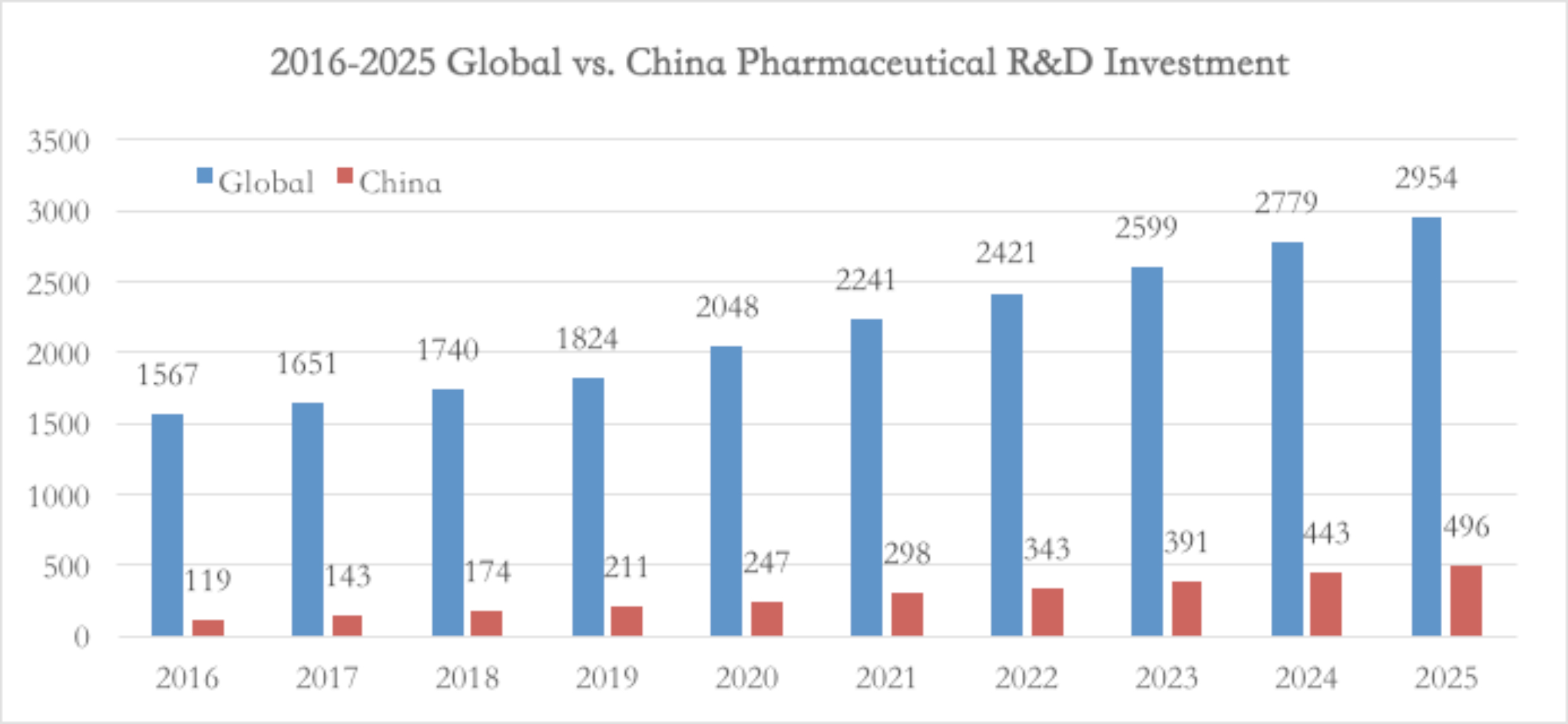

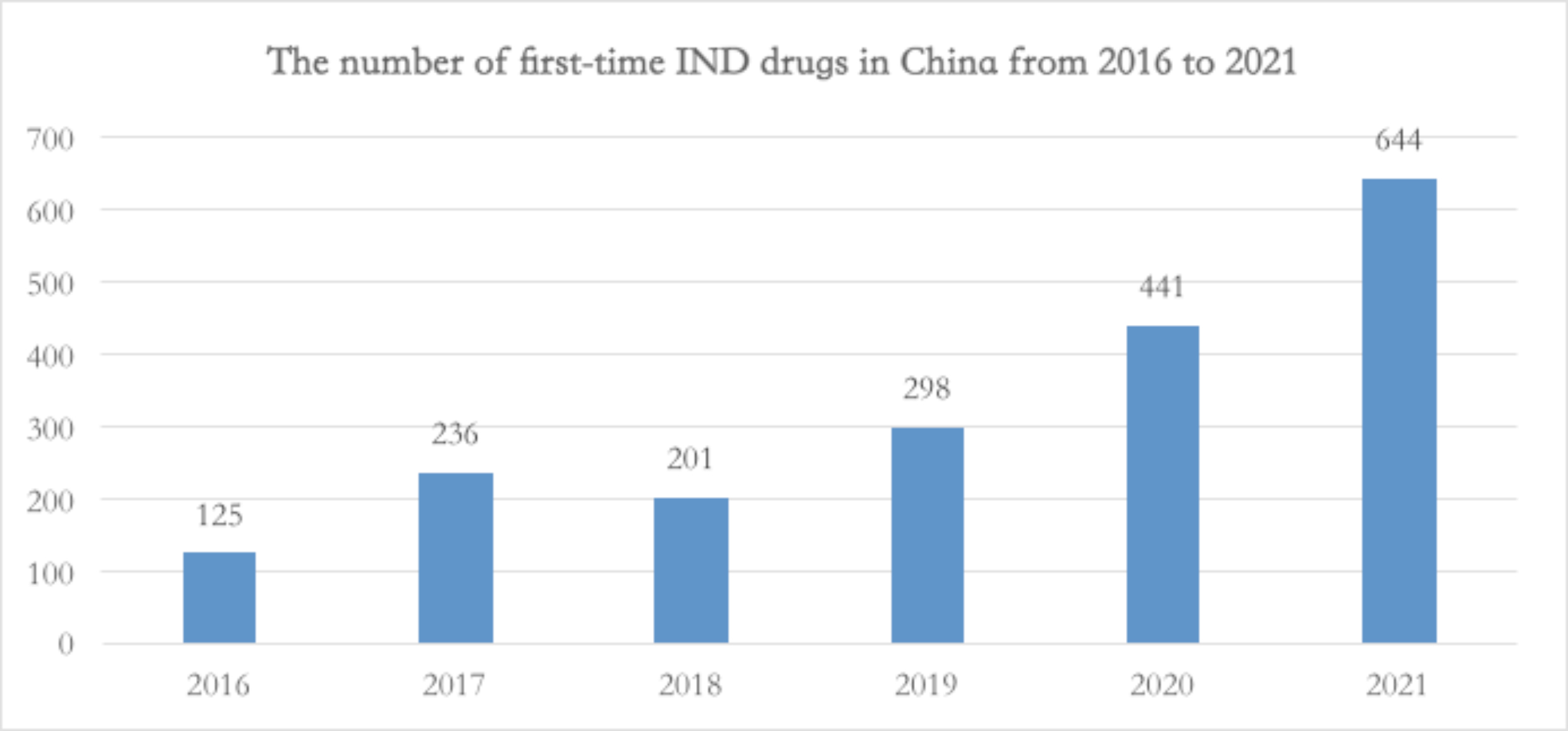

First, as global investments pharmaceutical R&D increases year by year, the number of drugs entering the IND (Investigational New Drug, new drug clinical trial application) stage is rapidly increasing, this inevitably leads to growth in demand of CXO services.

Later, U.S. CXO industry began re-locating towards places with more abundant and cheaper labour. Against this backdrop, the CXO industry in China emerged.

During this period, Chinese CXOs such as Joinn Laboratories (昭衍新药)(est. 1995), WuXi AppTec(药明康德)(est.2000), Pharmaron (康龙化成)(est. 2003), Tigermed Consulting (泰格医药)(est.2004) etc, were established. Leveraging global shift in pharmaceutical R&D and advantages of Chinese engineers, these companies rapidly expanded from single services into entire industry chains.

However, during the early years, CXOs were not favored by investors. The then prevailing view was that CXO, which bore the name of contract manufacturing, performed low value-added activity, unworthy of investment.

(Data source: 智慧药研; Cartography: JD Investment)

(Data Source:AskCI; Cartography: JD Investment)

Secondly, as the competitive edge of Chinese manufacturing strengthens globally, global production shifting to China is an irresistible trend. This holds true for the pharmaceutical industry, under continuous technological breakthroughs, the rate of localization of upper stream raw materials/equipment is gradually increasing, and achieving a relatively high comparative advantage in cost globally.

According to Frost & Sullivan’s forecast, by 2023, global CXO market size will be close to USD $1.5 billion. For the five years between 2017-2021, compound annual growth rate of China’s CXO industry was a high 42%, with market size reaching 44.4 billion RMB in 2021.

Over the past decade or so, in the medical and healthcare sector, surrounding entire chains of raw materials, chemical drugs, traditional Chinese medicines and medical devices, JD Capital systematically invested in companies including Autek China (欧普康视), (300595.SZ), Jiudian Pharmaceutical (九典制药)(300705.SZ), Weili Healthcare (维力医疗)(603309.SH), Guangxi LiuYao Group (柳药集团)(603368.SH),Nanlu ophthalmology hospital etc.

In this issue JD Capital Observation, we are focusing on the CXO industry, attempting to trace development trends in CXO, observing and identifying value in niche market segments. Key questions to discuss:

• Why is CXO worthy of attention?

1、Twenty Years of China’s CXO: Short Winter, Long Spring

In the 1980s, to curb rising medical costs, the U.S. initiated payment method reform. Consequently, U.S. pharmaceutical companies began outsourcing their R&D in order to reduce costs.

Taking WuXi AppTec (药明康德) as an example, it was listed on NYSE in 2007, the first Chinese bio-tech and R&D company to go public in the U.S.. However, until it was delisted from the U.S. stock market in 2015, its market value was merely USD $3.3 billion.

It was also in 2015, China began implementing reforms on the pharmaceutical, medical devices review and approval system. The continuous rollout of related and supporting policies, e.g., the MAH system (Marketing Authorization Holder), led to transformative improvements in China’s medical innovation environment. Subsequently, more and more scientists joined the wave of pharmaceutical entrepreneurship.

After 2018, the HKSE implemented the 18A policy. SHSE, after the Science and Technology Innovation board, opened new channels for biopharmaceutical innovative companies, igniting investor sentiments in the pharmaceutical capital market, more and more related companies mushroomed “like bamboos after spring rain”. The number of innovative drugs R&D development pipelines grew exponentially, the CXO industry entered a period of explosive growth.

Under this macro trend, WuXi AppTec (药明康德) amongst many other CXOs were able to be listed on both domestic and Hong Kong stock exchanges (A + H shares). Jul 2021, WuXi AppTec’s share price reached a historic high of 171.97 RMB per share, with a total market value close to 500 billion RMB.

However, the improvement in China innovative drugs R&D capability could not happen overnight. With R&D capability unable keep up with the overflow of a large quantity of R&D projects, China’s pharmaceutical sector evolved from a repetition in low-end generic drug production to a high-end repetition of “me-too” drugs (with separate patents, but minimal breakthrough compared to existing drugs).

Thus, came the 2021 CDE warning. Before the warning, CDE also issued Guiding Principles for Clinical Value oriented Clinical R&D of Antitumor Drugs (《以临床价值为导向的抗肿瘤药物临床研发指导原则》).

JD Capital believes, CDE’s guidelines and warnings, when viewed from the short term, has a deflationary effect on the pharmaceutical R&D and the CXO bubble, temporarily slowing down sector growth; but when viewed from the long term, it is seen as beneficial, as it encourages efficient allocation of resources towards more valuable R&D pipelines, fostering a virtuous cycle in pharmaceutical R&D environment.

As for U.S. policies towards boosting American bio-manufacturing, JD Capital sees it having trivial impact on the Chinese CXO industry.

First, as previously mentioned, from the perspective of international divisions of labour, the global shift of CXO capacity and orders to China is an irreversible trend of the era. Separation in the supply chain is driven by commercial and business interests, not political. Moreover, most of the contracts China receives from the U.S. are within the lower tiers of the value chain.

Second, there are inherent difficulties in the re-location of bio-manufacturing industry, existing projects become harder and harder to re-locate moving towards the later stages, thus, high customer stickiness. Reasons are as follows:

• biopharmaceutical R&D and production services, especially those involving customized CDMO services, have high professional barriers.

• The clinical trials and market approvals of biopharma products are subject to regulatory supervision by various countries. Particularly for already commercialized products, changing suppliers will require re-approval from related agencies, which usually take at least 1-2 years involving technology transfer, production, and filing.

Furthermore, to counter geo-political risks, many Chinese CXOs have acquired foreign production capacities or have established factories overseas.

e.g., in 2022, Pharmaron (康龙化成) successively acquired raw material bases in Cramlington, UK, and Coventry, U.S., with intentions to further expand its global small-molecule production and service capabilities; WuXi AppTec(药明康德) also announced plans to establish R&D and production bases in Singapore, with projected investment of 2 billion SGD over the next decade.

It is also empirically proven, that the challenges experienced by China CXOs in the past two years were merely minor setbacks.

As when this issue was written, many Chinese CXOs announced their 2022 annual performance forecasts, with a high rate of positive expectations. In particular, WuXi AppTec expects to achieve a revenue of 39.355 billion RMB for 2022, an 71.84% increase yoy; realizing net profit attributable to the parent company of 8.814 billion RMB, up 72.91% yoy.

2. the Value Proposition of CXO: significant rift between niche segments, “shovel sellers” can mine too.

Surveying the past two decades, the CXO industry has shown an overall upward trend, from ‘cold’ to ‘hot’. What exactly, are the values of CXO, under the name of contract manufacturing?

JD Capital believes, different from other forms of contract manufacturing, there exist a high entry barrier to CXO. Due to inherent high barrier of the pharmaceutical industry itself. For example, despite following similar pathways -R&D to Production to sales - the commercialization of pharmaceutical products (i.e., new drugs) are much harder compared to other industries – the consensus holds that it takes at least 10 years and investments over USD $1 Billion, with a success rate of less than 10%.

Within the CXO sector, there are specialized fields that of: CRO (contract research organizations), CMO/CDMO (contract manufacturing organization/Contract development and manufacturing organization),CSO(contract sales organization).

Of which, CRO can be further sub-divided into pre-clinical CRO and clinical CRO.

• The former is mainly involved in services such as new drug discovery, synthesis and process development of lead compounds and APIs, safety evaluation research, pharmacokinetics, pharmacology/toxicology, and the construction of animal models/organoid models.

• The latter focuses on services during the clinical trial phases, encompassing technical services from Phase I to IV, clinical data management and statistical analysis and new drug registration filings.

For CMO enterprises, if they have the capacity for customized development (D), they can be upgraded to CDMO companies. Essentially, CDMO is a partial crossover of CMO enterprise towards CRO. CMO/CDMO can be further distinguished into laboratory or factory types according to the stages of their service (typically with Phase I clinical trials as the dividing line).

(Source:Publicly available information;Cartography:JD Capital)

There exist strong synergies within certain niche segments due to similar asset characteristics, e.g., pre-clinical CROs and Laboratory CMO/CDMOs. Companies like WuXi AppTec, Pharmaron, and ChemPartners (睿智医药) all started out as CMO/CDMO chemical synthesis laboratories, then grew and expanded into providing pre-clinical CRO services.

In other niche segments, however, there exist significant divides. e.g., pre-clinical CROs are leaned towards scientific research, with laboratory size and no. of researchers being its main indicators of capacity; clinical CROs on the other hand emphasize resources (establishing clinical trial bases even), mainly assist in the advancement of clinical trial progress, connecting quality clinical hospital/patients with potential innovative drugs, serve mainly as an intermediary, with the no. of business personnel as a main indicator of capacity.

For this, there is an industry saying that goes “pre-clinical CROs needs only to ‘decorate’, while clinical CROs needs to ‘cast a net’”

JD Capital has observed that even CSOs – seldom favoured by the capital market due to issues such as un-standardized/opaque financial practices, have their own unique irreplaceability.

This is because, sales/marketing is a major weak point for many pharmaceutical companies. Especially foreign companies and entrepreneurs with strong research and academic background, handling relationships with local governments and enterprises, getting informed on conditions of local doctor-patient market relationships can be especially challenging. Once a company’s drug patent expires, they will face immense market competition, pushing them towards further disadvantage at drug promotion.

Moreover, China is large and populous, how to make pharmaceutical products reach their terminal user through the labyrinth of provincial, city, and county channels requires specialized CSOs to organize and propel.

Currently, lead companies performing distinct tasks have emerged within each niche segments of CXO. E.g., Joinn Laboratories (昭衍新药) specializes in pre-clinical CRO services; Tigermed’s core operation is clinical CRO; Asymchem(凯莱英) sits at the top of small molecule CDMOs; China Medical System(康哲医药) is the CSO sub-segment leader.

More ambitious and capable lead CXO companies such as WuXi AppTex have undergone integration. Regarding the “record-breaking” revenue growth in 2022, WuXiAppTec attributes it to their unique CRDMO (contract research, development, and manufacturing) and CTDMO (contract testing, development, and manufacturing) business models.

Having built sufficiently high barriers, some leading CXO enterprise have become revered by the industry.

E.g., HitGen or Chengdu Pilot(成都先导), with pre-clinical CRO being its core operation, has forged the DNA-encoded compound library technology into its competitive edge. This services as an engine for small molecule drug discovery, offering a vast collection of compounds (ranging from billions to trillions), significantly larger than traditional high-throughput screening (millions), thereby reducing workload for target & assay preparation, and shortened the hit compound identification cycle.

“shovel-sellers” with unique set of expertise can indeed mine gold for themselves.

As early as 2020, HitGen transferred its mainland China patents for all potential therapeutic areas and indications of Class 1.1 anti-tumor innovative drug HG030 to Baiyunshan Pharmaceutical Factory, making it the first transfer of independently developed drug project.

HitGen founder Li Jin, stated that if providing only CRO services, the company cannot fully leverage its capabilities and values. Thus, the company decided to sell a portion of its rights to new drug development projects, receiving milestone fees and post-market sales fees, then reinvesting these cash flows into other new drug development projects to create a virtuous cycle.

To some extent, HitGen has pioneered an exemplar path for more CXOs to follow.

another industry consensus holds that, in recent years, talents returned from overseas, brought in European and American R&D standards to China, contributing to the industrial R&D and planning upgrade of Chinese pharmaceutical industry. Taking this perspective, CXOs have indeed helped advance Chinese pharmaceutical industry.

3. deepen understanding of these niche segments, China has opportunity to nurture world-class CXOs.

To date, China has over 20 relevant CXOs listed on both “A+H” shares.

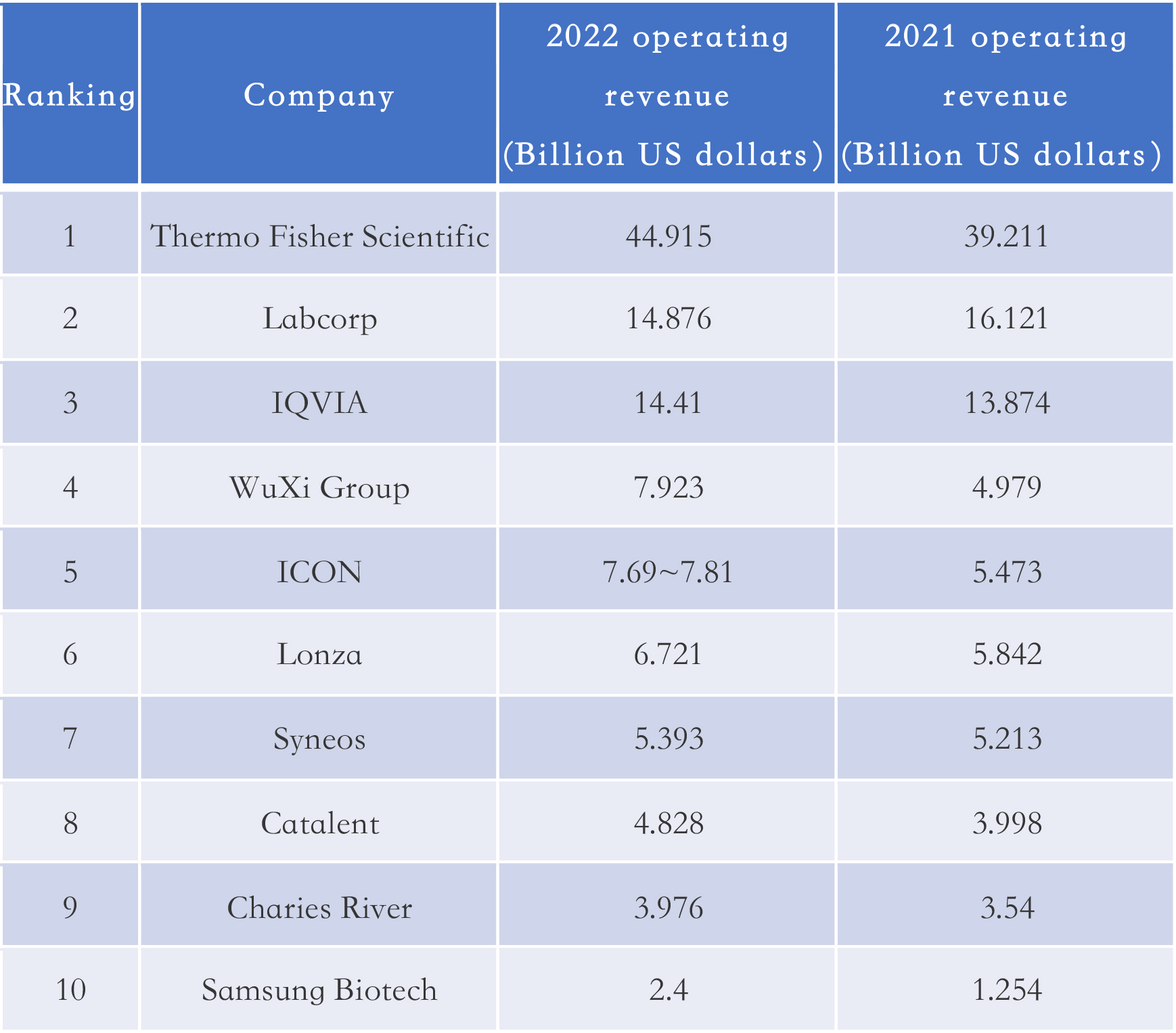

However, the scale of Chinese CXO development is still small compared to international counterparts. According to statistics from E Drug Manger (A Chinese pharmaceutical magazine), only one Chinese company (WuXi Companies – WuXi AppTec + WuXi Biologics) made it into the global top ten CXOs list 2022 ranked by revenue.

(Data Source: Healthcare Executive; Cartography: JD Capital)

JD Capital believes that in an developing economy like China, the CXO industry possesses great potential for “rising with the tide”.

Of course, development of each sub-segments differ.

E.g., Clinical CROs exhibit a strong leader effect, making it very difficult for small and startup companies to challenge lead companies such as Tigermed with large scale and channel networks.

As new players continually entering the field, excess capacity have emerged in the CMO/CDMO sector, typically in small molecule CDMOs.

In recent years, the popularity of biomacromolecules drugs, represented by antibody drugs, continues to rise. However, small molecule are still the major arena for innovative drugs due to its lesser quantity, lower R&D cost, and relatively mature processes.

Research published in the Journal of the American Medical Association; FDA approved 581 new drug applications between 2008-2021. Of which, 442 were small molecule drugs, accounting for over76%. In other words, small molecule drugs development has entered “red ocean” competitive stage.

JD Capital observes, however, certain emerging niche segments of pre-clinical CRO and CDMO are worthy of attention, such as pre-clinical CRO’s drug discovery, lead compound synthesis, organoid cultivation, as well as biologics CDMO and CGT (Cell and Gene Therapy) CDMO.

Taking drug discovery as an example, as the first and foremost stage in new drugs R&D, it has pivotal position. According to the China Business Industry Research Institute, the market size of China’s drug discovery CROs is relatively small (about 22 billion RMB in 2022), still has significant room for growth.

Looking at macromolecules CDMO, the bio-pharma preparation often involves techniques such as cell engineering, fermentation, etc, the processes are often continuous fermentation and production, where are difficult to disassemble. Compared to chemical small molecules, biomacromolecules are less stable and harder to transport, hence, macromolecules CDMO companies possesses characteristics of high order stickiness and high barriers.

Additionally, the medical device CXO is an emerging sub-segment that deserves attention in recent years.

In the past, there were only a handful of medical devices with large sale volumes, and the manufacturing process was primarily done in house. JD Capital observes during due diligence process, that contract-manufacturing model has started to emerge in the medical device field in recent years.

Similar to medicine CXO, medical device CXOs provide one-stop services from R&D to final market production of medical devices. But, size of medical device CXO orders are far less than those of medicine CXOs. Typically, an order for a medicine CXO could reach above ten million, while medical devices CXO are typically less than 1 million.

Encouragingly, following the pilot drug MAH (Marketing Authorization Holder) system in 2015, China also began piloting the medical device MAH system in 2017,gone is the rigid model - where individuals could not register independently, and medical devices registration license locked-in with production - thoroughly opening up the market to medical device CXO demands.

In the future, as medical devices market increases in volume, CXO in this field will have great developmental potential.

From the perspective of corporate development, the key to cultivating sub-segment and establishing competitive barriers lies in:

First, unique, and cutting-edge technologies. The core to providing service is timely delivery, and timely delivery is based upon technology.

Second, a sound sales and distribution network. Commercial capability and ability to control the commercialization process, determines the long-term commercial value of the enterprise.

Third, lower costs without compromising quality of service. Cost control is related to technological capabilities and production scale. Different technological links, design, and production process, will bear cost differences. The larger the production capacity, the greater the economies of scale, the lower the cost.

Fourth, short response time. Especially for those customized service CDMOs, this is an important indicator.

Overall, China is a large country in terms of economy and population, with continuous increases in the pharmaceutical industry and medical demands. Coupled with increasing re-location of manufacturing into China, the Chinese CXO industry has a lot to offer.

JD Capital posits, if CXOs can delve deeper into prosperous niche segments, and quickly establish their own advantage and barriers, seizing the opportunity to become large companies in China, they can also become world-class companies.